When wealth and the Middle East are uttered in the same breath, many of us immediately think of oil. Indeed, petroleum or crude oil, also known as black gold, has traditionally been the source of high revenues throughout the region, both for private corporations and governments.

Yet there are signs that in the Middle East large profits are to be made not only in oil. A recent report by Knight Frank, a London-based real-estate consultancy, indicated that the number of “demi-billionaires” in the Middle East is on the rise. And analysts are pointing to sectors beyond the traditionally lucrative ones of oil and gas.

Demi-billionaires are essentially those who have amassed great wealth, but just shy of a billion dollars. They are individuals with a net worth—including stocks, properties and other assets—ranging between $500 million to $999 million. According to the Knight Frank report, they are set to increase by 28% in the next four years, taking their numbers from 390 in 2017 to 500 in 2022.

To measure this wealth against other regions, Wealth-X, a global research firm that contributed to the Knight Frank report, predicted that in the next four years, Asia will outpace North America in the number of demi-billionaires. The former could net more than 3,000 people in this category, compared to nearly 2,500 in the U.S. (up from 1,830 in 2017), though the latter remains the single country with the most demi-billionaires.

The rise in demi-billionaires coincides with the overall increase of a global and wealthy elite, which includes millionaires on the lower end of the spectrum and those who have surpassed the billion dollar mark on the higher end. The same report predicts that the number of demi-billionaires around the world will increase from 6,900 in 2017 to 9,570 in 2022.

What Middle Eastern countries are on track to notch the highest numbers of demi-billionaires? The report predicts that Saudi Arabia will come out on top; it will increase its share of the ultra-wealthy by 17%, totaling 140 individuals by 2022.

The report, however, did not touch on other countries, though it is well known that in terms of just billionaires alone, Israel, Turkey and Lebanon have the largest concentrations of them.

What sectors are the most lucrative?

According to Bill Law, a Gulf analyst with TheGulfMatters.com, the oil and gas sectors in Saudi Arabia remain by far the biggest players.

“But other sectors showing potential and promise include entertainment, tourism, alternative energy, information-technology, and new technologies related to artificial intelligence and defense industries,” Law said.

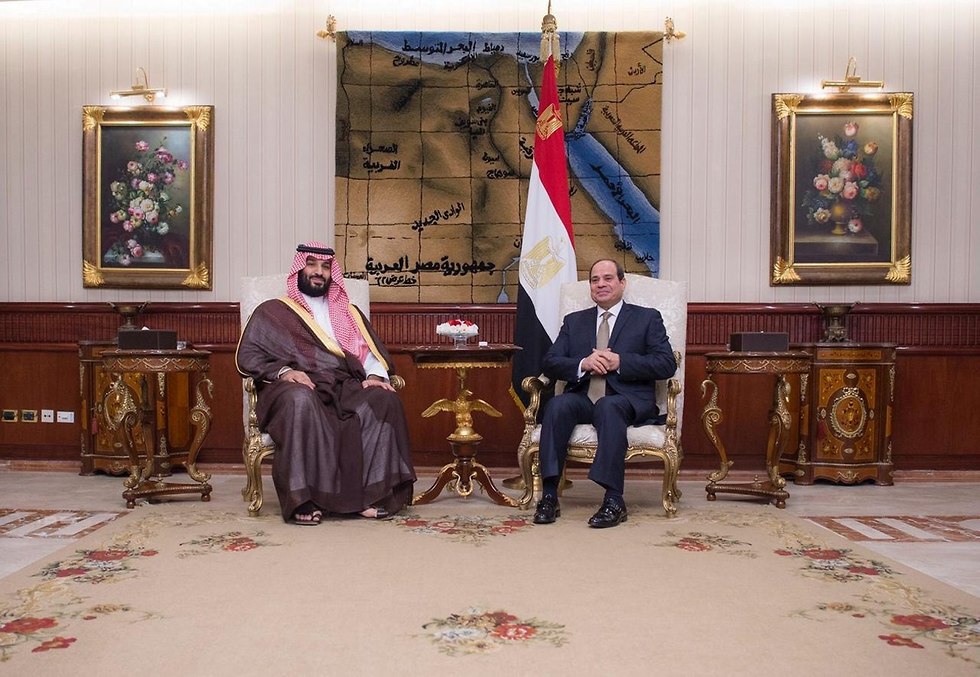

“These are all sectors highlighted in Saudi Crown Prince Mohammed Bin Salman’s Vision 2030. But as much as his initiative aims to empower the private sector, this is an economy driven from the top down. Those who want to benefit from the opportunities presented by the crown prince’s radical remaking of the Saudi economy must be sure not to criticize or cross him.”

Law added that the consequences of any perceived political or economic challenge to Bin Salman are clear. “Witness the mass arrest of leading businessmen and senior members of the ruling family in November of last year. They were released only after agreeing to turn over most of their assets to the government.

“So yes, the opportunities to become a Saudi demi-billionaire are enhanced under Bin Salman, but so too are the risks.”

Ellen R. Wald, a Saudi expert and president of Transversal Consulting where she specializes in geopolitical and energy concerns, said that Saudi investment companies have been eyeing hotels, diary production, telecommunications, real-estate and technology enterprises where they see opportunities to accumulate great wealth.

“But many of these opportunities depend on close connections to the government,” Wald said. “It is very much a matter of what your pedigree is and your relationship to the royal family.”

In the UAE, on the other hand, Wald explained that the government has made an effort to develop the finance and attract international businesses and banking. The country is ruled by a monarchy, which means that business people are wise to forge links with the ruling elite, but perhaps not to the extent that they must do in Saudi Arabia.

“Real-estate is also a very big sector in Abu Dhabi and Dubai, mostly because it is an area in the Gulf that is more comfortable for Westerners to live in.”

When asked about ethical questions that might arise over the concentration of huge wealth in the hands of a few, Wald said that such issues are not evident in the public discourse. “As a rich member of society, if you give an appropriate component of your wealth to the right charities, then your wealth is certainly not looked down upon,” Wald concluded.

“I don’t think people in the region see anything wrong with flaunting wealth as long as one at least pays lip-service or donates to the appropriate Islamic charity.”

Article written by Terrance J. Mintner

Reprinted with permission from The Media Line