Inflation making a comeback

The Consumer Price Index was up 1.1% in July, the Central Bureau of Statistics reported Friday. The main reasons for the rising prices were the government and Knesset's decision to raise the value-added tax, and the rise in the price of water due to the "drought levy".

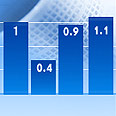

This is the fourth high CPI in a row, after June's index rose 0.9%, May's index rose 0.4%, and April's index rose 1%, despite the financial crisis which has yet to end, the recession and the dismissals in the labor market.

An accumulated inflation rate of 3.2% has been recorded since the beginning of the year. In the past 12 months (since August 2008) the CPI rose 3.5%, due to a low inflation rate in the second half of 2008.

If this trend continues, it would be the third consecutive year of inflation in the Israeli economy. An inflation of 3.8% was recorded in 2008, and in 2007 prices were up 3.4%. This is also the third consecutive year in which the July CPI increases by 1.1%.

Economists' predictions were wrong, failing to foresee the high CPI. The Harel Finance company and the Yashir Investment House estimated Thursday that the CPI would rise by 1%. Treasury economists and Leader Capital Markets predicted a 0.7% rise.

Sources in the capital market now estimate that the August CPI will also rise sharply. If these predictions materialize, the accumulated inflation for January-August will total about 3.5%, beyond the government's inflation target.

Government pushes CPI up

The high consumer price index is partly the result of moves initiated by the government, including raising the value-asses tax, introducing a "drought levy", and raising the tax on petrol, cars and cigarettes.

In addition, the CPI is affected by the rising prices of goods worldwide, the market's recovery, and the ongoing increase in housing prices due to the significant drop in the number of available apartments for sale and the low interest on mortgages.

The rise in the CPI is exclusive to Israel, while other countries record a drop in inflation and some record a negative inflation.

Due to the high CPI, Bank of Israel Governor Stanley Fischer is facing a dilemma: The Bank of Israel lowered the interest rate sharply over the past year, like all other central banks in the world, in order to fight the economic crisis. Now he may have to raise the interest rate in order to try and curb the inflation, but this may worsen the recession and lead to dismissals of employees.