Foreign investment in Israel cut by half in 2014

UN World Investment Report says Gaza op to blame for sharp decrease in foreign direct investment; report recognizes Israel as a world cyber superpower.

Foreign direct investment (FDI) in Israel dropped by nearly 50% in 2014 compared to 2013 according to a report by the The United Nations Conference on Trade and Development (UNCTAD), which tracks changes in global foreign direct investment worldwide. The report contains one very glum statistic; in 2014 $6.4 billion were invested in Israel, whereas in 2013 $11.8 billion were invested - a decline of about 46%.

Moreover, Israeli FDI investments abroad also decreased from $4.67 billion in 2013 to $3.97 billion, a decrease of 15%. These figures are significantly lower than the corresponding figures from 2007 to 2005, before the outbreak of the financial crisis in 2008.

"We believe that what led to the drop in investment in Israel are Operation Protective Edge and the boycotts Israel is facing," Dr. Roni Manos of the College of Management and one of the authors of the report's summary told Ynet. According to her, these are only conjectures that can explain the sharp decline, but there is another reason. "In the past there were large transactions such as Waze and ISCAR Metalworking which boosted investment, but over the past year there were not enough such deals."

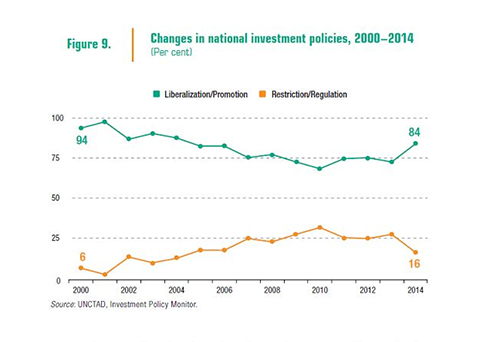

But the decline is not just in Israel. According to the UN report, world FDI investments during the past year amounted to only $1.23 trillion, a 16% drop compared to 2013 ($1.47 trillion dollars). However, when one considers the forecast given in 2014, the decline is march sharper. The UN's World Investment Report (WIR) estimated last year that the FDI would total $1.6 trillion, in other words, with respect to the 2014 forecasts, FDI fell by 23%.

The main reason for this, according to the report's authors, is weak global economic growth and uncertainty regarding economic and business policy in many countries, which deterred many investors. Among others, the uncertainty due to the rate of quantitative easing in the US and Europe, the Greek debt crisis and its impact on stability in the Eurozone, and the pace of economic growth in China.

Other factors influencing the decline in global FDI were geopolitical risks such as the conflict in Ukraine, which has calmed down in recent months, the worsening of relations between the West and Russia, and revolutions and regime changes in several countries in the Middle East. Large scale divestment has also contributed to a decline in FDI. A prominent example is Vodafone's divestment of Verizon amounting to $130 billion..

Israel- a cyber superpower

Recent cyber attacks on government sites, infrastructure, militaries, and large companies all over the world, have led to a dramatic increase in investment in data and communications security, and have proved that Israel is a cyber superpower. The UN WIR report indicated that Israel has a comparative advantage in this area and is considered to be a cyber superpower. The most prominent Israeli company in data security is Check Point Software Technologies Ltd. which is traded at a value of $15 billion.

Moreover, the report's authors mention Israel favorably, along with other countries, regarding reforms that encouraged competition, the entry of new players, improving efficiency and lowering prices, such as the reform of the Israeli communications market.

Israel also registered in 2014 an increase in private investment funds, which totaled about $2 billion and were carried out mostly by foreign funds. The upward trend in the importance of private investment funds in Israel and around the world is expected to continue. The reason for this is growing investor interest in this sector, especially due to current low interest rates which pushes large pension funds and other institutional investors to seek additional yields in alternative investments at the expense of traditional investments.