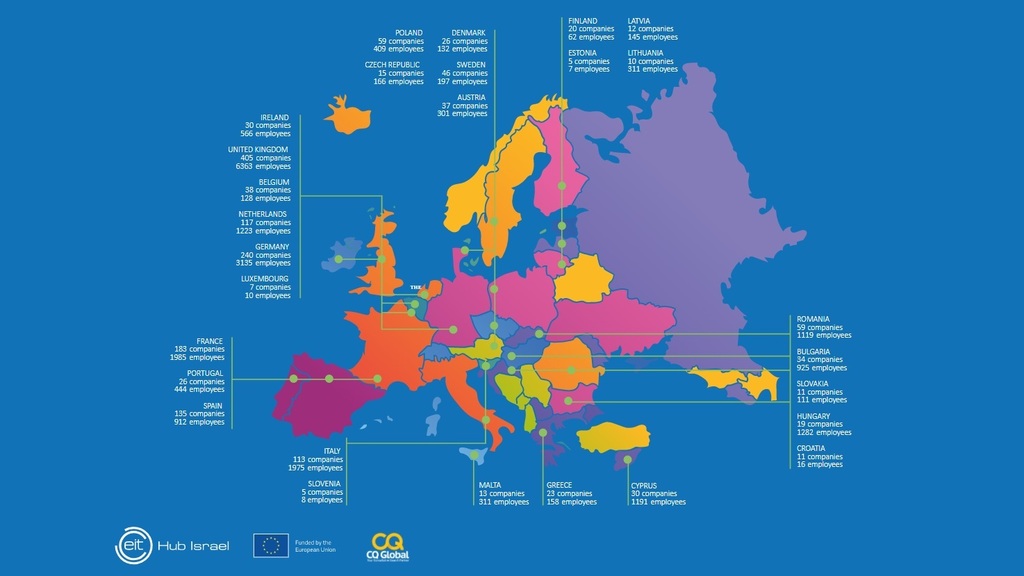

A new report seeking to create clarity regarding the extent of operations of Israeli startups in the European market shows 912 companies currently operate in 28 countries throughout Europe.

The largest number is active in the UK, with 405 firms employing more than 6,000 locals, followed by Germany and France.

Traditionally, expansion and integration into the American market is considered the goal for Israeli tech companies, but the report shows the significant number of companies already active in Europe.

“A big majority [of companies] turn to the American market,” says Yotam Tzuker, who heads business development the Israeli tech-centered headhunting firm CQ Global.

CQ Global took part in the authoring of the report. However, in recent years, the local tech sector has started looking toward the European sector, says Tzuker.

A variety of factors are informing the companies’ orientation towards the continent.

“The European market is a huge market,” says Tzuker, and its size allows for significant growth potential that simply cannot be found within Israel’s tight boundaries.

When compared to the U.S., the fact that Europe is near at hand plays a big role, he says.

One can get on a plane and be in London, the European business hub furthest from Israel, in five hours.

This closeness makes it easier to make your first steps and branch out to Europe, it helps when one needs to relocate employees, and critically, it means that the difference between time zones is minimal.

Similar time zones mean it’s significantly easier to offer services and be available to potential and existing clients, even without being in Europe physically.

Aside from the geographical closeness, Tzuker says that there are certain cultural similarities “compared, let’s say, to the Far East. … We are familiar with the European culture; we’ve met Europeans and we know how to manage ourselves in a European setting.”

Optimove, an Israeli company that offers a holistic customer management solution, innovative because of its use of artificial intelligence, is one such company, with offices in London and approximately 50% of its revenue coming from its European clients.

“Doing business with Britain is easier, in our experience, at least compared to the U.S.,” says Moshe Demri, general manager of Optimove’s London branch.

It’s easier “first and foremost because of the time zone, when it comes to supporting large clients,” he says.

“The ability to spend a few days a week at the clients’ office was, at first, significantly easier.”

Demri also points to the large expansion potential in the British market and says that administratively, it was easier to branch out to the UK.

Opening a business and arranging the working permits for their Israeli staff that was relocating to their new offices was relatively simple.

Compared to the U.S., he says, the process of relocation “is a lot shorter and more straightforward,” and it’s cheaper.

“It allowed us to transfer a small team relatively quickly and start recruiting local people, and that really opened the path to Europe for us,” he says.

Tzuker says: “You can build an entity or an operation in one location and basically have access” to more than 20 other markets in the EU.

The tech companies operating in Europe belong to a diverse set of subsectors. The largest segments are IT and software companies, internet companies constitute a fifth, while cleantech and communications each have approximately 10% of the pie.

3 View gallery

L-R: Yotam Tzuker, head of business development at CQ Global, and Adi Barel and Yoni Levenfeld of EIT Hub Israel

(Photo: Idan Canfi)

Additional contributors to the report are Adi Barel and Yoni Levenfeld of EIT Hub Israel, part of the large European Institute of Innovation and Technology (EIT), an EU institution that seeks to encourage innovation in the continent, and by the continent’s residents.

Its Israel hub, founded in 2019, was created to be a bridge between the local startup scene and interested parties in the EU.

Levenfeld says that an additional reason for Israeli companies’ interest in Europe is grants given by the EU.

Sixteen percent of companies questioned by the researchers said that they had received support from EU grants.

Levenfeld points to the large European Horizon 2020 fund, which had more than €80 billion to invest in innovative projects, from tech companies to research projects, and which was open to application from Israeli companies.

Following that program, which ended in 2020, Horizon Europe, with a budget of €95.5 billion, is now active and “intended to encourage innovation in specific fields which the European Union defines as strategically [important] to humanity,” Levenfeld says.

Another advantage of the EU is its advanced regulations regarding environmentally beneficial technologies.

“Specifically with regards to climate[-related technologies], you can see that Europe is significantly more advanced than Israel,” he says, giving an example that a solar energy company wishing to connect to the city grid would have a much easier time doing so in Europe than in its home country.

Demri highlights a possibly surprising plus for Europe, which the report’s authors did not mention – the costs of employment.

“England is attractive because of costs,” he says, for compared to New York, hiring anyone, be they engineers or salespeople, is considerably cheaper.

Levenfeld, who works for an EU organ, summarized the European interest in the local industry in three words: technologies, talent, know-how.

The EU and the Israeli companies’ European clientele are firstly looking for Israel’s innovative technology.

The know-how they are looking to absorb has to do with the integration of new technologies.

“There are methods and practices of innovation here” in Israel, Levenfeld says.

For example, he says, a huge Spanish company is working with them to learn how to engage with the startup ecosystem because it wishes to develop a department focused on innovation.

Some European companies also come to Israel to learn how to scale to the global level, he explained. Because of Israel’s small size, companies growing here are all directed outward, and this is something which companies from the EU want to learn from.

Despite the long list of advantages and opportunities found in the flourishing relations between Israel’s tech sector and Europe, the American market’s primacy doesn’t appear to be going anywhere.

Optimove, despite the importance of the European market, also has a New York office.

“It’s a market you have to be in," Demri says. "You want to play in the big leagues, and that’s apparently the U.S.”

However, a majority of the companies questioned expected to grow and recruit more employees to their Europe offices.

The report itself is intended not only as a benchmark of activities, but also as a tool to interested Europeans and Israelis looking to add to the prospering cooperation.

“There’s no reason why the European market shouldn’t be much more significant,” Tzuker says.