Since the crypto platform Polymarket was launched in 2020, it was built on blockchain infrastructure and has since experienced ups and downs. Although it defines itself as a “prediction market,” one it claims can forecast outcomes better than polls, in practice it is a sophisticated betting arena in which almost anything can be wagered. Behind the promise of the “wisdom of crowds,” criticism has grown that participants do not always rely on the same information.

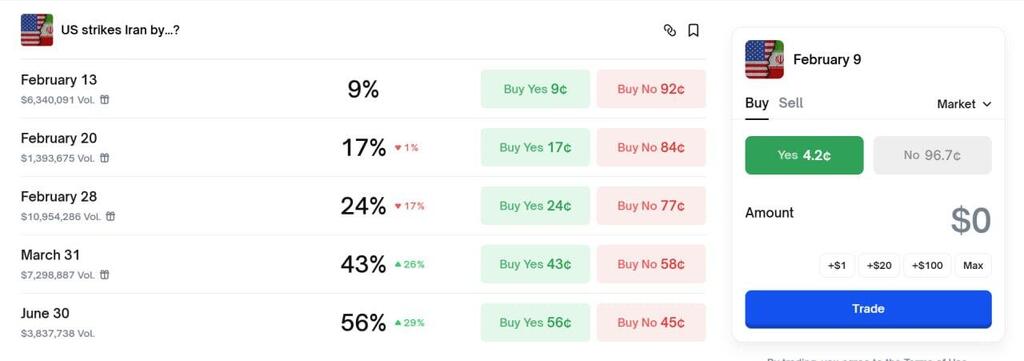

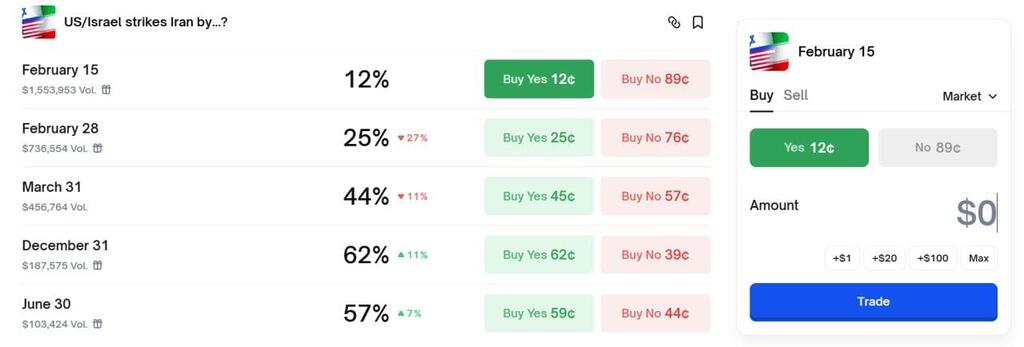

Unlike traditional stock exchanges, Polymarket is not subject to tight regulation, and any anonymous user can bet, or invest, on highly sensitive scenarios: whether a war will break out, whether a government will fall, whether a specific candidate will be elected and more. The problem is that such activity is not always a wager or an “informed guess,” but sometimes based on advance knowledge. Questions have repeatedly been raised about large bets placed just moments before an event actually occurred, such as the release of election results or a military strike.

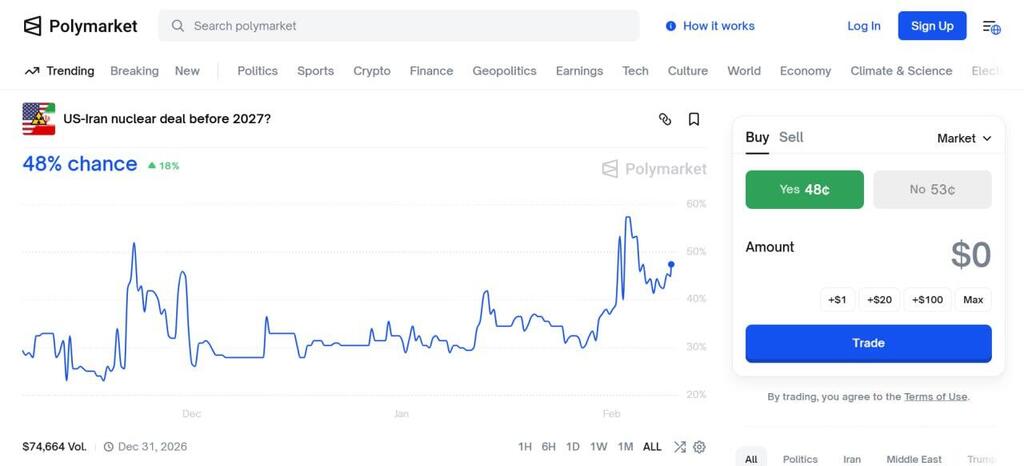

In effect, Polymarket has faced recurring suspicions of trading based on inside information. Only at the beginning of last month, a user earned more than $400,000 after betting that Venezuelan President Nicolas Maduro would be removed from office, just hours before a U.S. raid on the country and Maduro’s arrest. In response, Congress began advancing legislation that would bar federal employees from trading in markets such as Polymarket. In Israel as well, mainly against the backdrop of the war with Iran and exchanges between the two countries, the platform has gained momentum.

Since the site’s launch, Polymarket users have correctly predicted several major global events, even when commentators, experts and even statisticians believed otherwise. The most prominent case was betting on a victory by Donald Trump in the U.S. presidential election, at a time when polls predicted a win for Kamala Harris or a very tight race.

Yet this is precisely where the gap lies. Making a financial investment based on analysis of polls, an understanding of political dynamics and accessible sources of information, or even a decision based on intuition, is considered entirely legitimate. By contrast, using information not available to the public, obtained through one’s position or via an unauthorized leak, constitutes an offense.

In any case, within a relatively short time Polymarket has evolved from a betting site into a source that offers real-time forecasts of expected trends in financial, political and cultural markets. This year, the site also recorded an unusual partnership with Dow Jones, the News Corp division and one of the world’s leading publishers of business and financial media. “It is a rapidly emerging source of real-time insight into collective beliefs about future events,” Dow Jones said.

Polymarket’s activity has not been free of problems. Over the years since its founding, it has repeatedly encountered difficulties. Countries including France, Portugal, Hungary, Belgium and Switzerland have blocked the site after determining that it enables illegal gambling. In the United States, regulators ruled in January 2022 that it was an illegal exchange, fined the company $1.4 million and ordered it to cease operations in the country.

Toward the end of 2025, after obtaining the appropriate license, the company returned to the United States. Even before that, it drew massive participation during the most recent U.S. presidential election. During that election cycle and through the end of October 2024, users wagered a total of more than $2.7 billion on the platform.

Now, as the platform continues to gain momentum and influence, the need grows to ask: Is this a market that predicts the future, or one that exploits it on the basis of inside information?

First published: 21:09, 02.09.26