The year 2025 was historic for the Tel Aviv Stock Exchange. The TA-125 index surged 50%, the first time it has risen by more than 50% since 1999, ahead of the dot-com bubble burst. It was historic in another sense as well: never before has the gap been so wide between Wall Street’s S&P 500, which posted “only” a 17% return, and the Tel Aviv indices.

It was also the year foreign investors returned to Tel Aviv, buying shares worth 4.3 billion shekels in the hottest sectors, defense and finance, after selling stocks the previous year. Israeli investors, for their part, piled into the market, purchasing shares totaling 13.7 billion shekels.

In 2025, it turned out that investors did not need to be particularly sophisticated to make money on the Tel Aviv exchange. Shares of about 48 companies jumped by more than 100%, roughly 140 climbed more than 50%, and some 300 delivered double-digit returns.

The leading equity indices shattered records from the start of the year with double-digit gains, outperforming major global markets. The TA-125 rose 50%, the TA-35 jumped 53%, and the TA-90 climbed 46%, compared with 17.7% and 21.6% for the Nasdaq 100 and the S&P 500, respectively.

Space, defense and investment houses: The soaring stocks

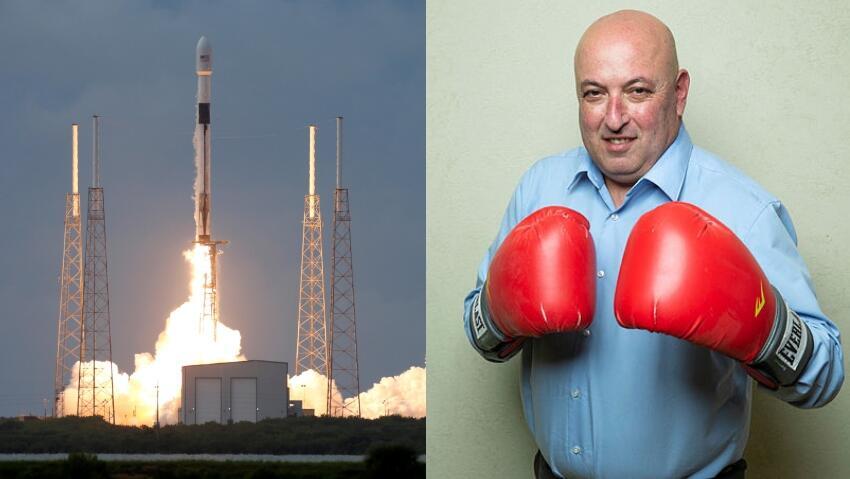

Topping the list of the year’s biggest gainers was Space-Communication Ltd., which posted a staggering 1,437% return. Among other activities, the company markets services for the Amos satellite fleet. In second place was Aryt industries from the defense sector, a manufacturer of fuses, with a 369% gain.

Third and fourth place went to two investment houses, Mor Investments with a 316% return and Meitav Investments with 310%. Both benefited from the market boom and from the launch of independent trading platforms for retail investors, which became hugely popular, especially among younger investors.

In fifth place was Merchavia Holdings and Investments Ltd, a medical technology investment company, with a 289% return. It was followed by CIE Defense, which develops integrated testing systems for night-vision equipment primarily for defense industries, with a 253% gain.

Seventh was Geex, up 232%, a company that began in digital advertising and moved into the hot fields of autonomous robotics and artificial intelligence. Turpaz, which specializes in developing and manufacturing flavor and fragrance extracts for the international pharmaceutical and food industries, ranked eighth with a 230% gain, becoming a market favorite thanks to rapid growth driven by mergers and acquisitions.

Ninth place went to Ayalon Insurance Company LTD, which posted exceptional profit growth with a 219% return, and to tenth place to NextVision from the defense sector, which develops and manufactures stabilized cameras for drones and has seen rapid revenue growth since its 2021 IPO, also up 219%.

Medical sectors: The stocks that sank

At the bottom of the table was Highcon Systems, which developed digital printing machines for cardboard packaging and counted digital printing pioneer Benny Landa among its investors. The company failed to generate meaningful sales while posting losses and was sold this year to investors for just 2.5 million shekels. Its shares plunged 95%.

PsyRx Bio-Tech - lost 92.4% of its value.until recently, operated under the name Cannabotech in cannabis. About a month ago, the company was merged into a new operation and its name was changed, under the leadership of Professor Itamar Grotto. Currently engaged in the development of medications for depression. The company develops novel treatments for severe depression combining psychedelic mushrooms and a substance derived from an African root, and is headed by Professor Itamar Grotto, former deputy director general and head of Public Health Services at the Israel Health Ministry. ForSight, which integrates 3D computer vision systems to assist drivers in preventing accidents, fell 87.5% this year and 94% over the past three years.

Other notable decliners included LivePerson, which develops AI-based conversational platforms and bots, missed forecasts and fell 97% over three years but has recently begun to recover; Purple Biotech, which failed to meet clinical trial targets and fell 85%; Cipia Vision, specializing in computer vision and AI for the automotive sector, which received a going-concern warning early in the year and dropped 84%; and BioLineRx from the biopharma sector, which has disappointed investors in recent years and fell 75%.

Ron Klein, head of the economic department at the Tel Aviv Stock Exchange, said that “a significant portion of the stocks that stood out on the downside are dual-listed companies from the biomed and technology sectors, which are influenced by trends in international markets.” The biomed sector, which requires many years to prove the effectiveness of new drugs, has disappointed in recent years, in part due to the listing of lower-quality companies during the 2021 IPO wave.

‘Banks have sufficient safety buffers’

Uri Ben-Dov, CEO of IBI’s mutual funds division, explained the differences between the Israeli market and Wall Street. “Just as the U.S. market is dominated by the seven large technology companies that make up much of the S&P, Israel’s market is tilted toward financials. Insurance companies and banks account for more than 50% of the index. Over the past two years they have been highly profitable due to high interest rates. The reason we do not have tech giants like those traded on Nasdaq is that Israeli companies sell themselves and exit. At the same time, the defense index exploded, as the whole world watched their performance live and stocked up here, despite the criticism directed at Israel.”

Asked which sector is weighing on the market, Ben-Dov replied: “Residential real estate. Over the past two years, the 90/10 financing schemes offered by developers, that’s our subprime, and it’s now blowing up in our faces. Israel is drowning in apartments. For years we were told there was a housing shortage, but today there are 84,000 unsold apartments, double the number of four years ago. There is also a record number of housing starts, 75,000.”

Uri Ben-Dov, CEO of IBI’s mutual funds divisionPhoto: Courtesy

Uri Ben-Dov, CEO of IBI’s mutual funds divisionPhoto: CourtesyHe added: “We were told new immigrants would arrive, but in reality we are seeing negative migration, more people are leaving than coming. They argue there is natural population growth, but when you look at births and deaths, they don’t factor in that about 20,000 apartments return to heirs. I foresee a long winter in the real estate market, which rose for 10 consecutive years. Like in "Phantom of the Opera," the mask has now been lifted from the developers and the bluff exposed.”

Asked whether this could trigger a chain reaction across the entire market, Ben-Dov said that he is "less worried about the banks. They made billions from the public’s current accounts thanks to high interest rates. They have sufficient safety buffers.”

Looking ahead to next year, Ben-Dov said that we are entering a complex period. "Looking back over the past 100 years, the stock market has delivered an average annual return of 10%, including dividends. Over the past decade, the average was 15%. Since October 7, 2023, the Israeli market has delivered a 110% return. That’s excess performance, so it is reasonable to expect the market to revert to its long-term averages.”

First published: 10:27, 12.29.25