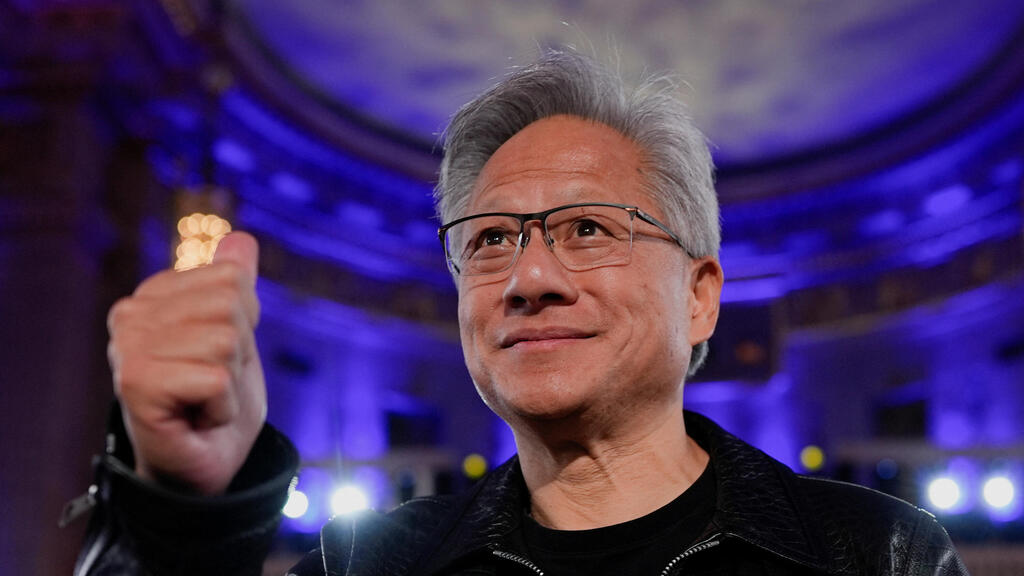

Nvidia (NVDA) reached a record $5 trillion valuation in after-hours trading on Tuesday, becoming the first company in history to hit that milestone. The surge followed a nearly 5% jump during regular trading, which lifted the chipmaker’s market cap to $4.89 trillion at the close.

The rally came after Nvidia unveiled a wave of new partnerships, investments, and AI initiatives at its GTC event in Washington, D.C., reinforcing its dominance in the global race for artificial intelligence infrastructure.

Among the highlights, the company announced collaborations with Eli Lilly, Palantir, Hyundai, Samsung, Uber, and Joby Aviation, along with a $1 billion investment in Nokia and a partnership with the U.S. Department of Energy to build seven new supercomputers, including one powered by 10,000 Blackwell GPUs.

The stock closed at $201.03, up $9.54 or 4.98%, before climbing further to $206.21 in post-market trading, a 2.58% gain that lifted its market capitalization above the $5 trillion mark, as Nvidia also announced a new partnership with Joby Aviation.

Other highlights included a plan with Uber to develop a 100,000-vehicle robotaxi fleet, a new system connecting quantum computers to Nvidia’s AI chips, and expectations of $500 billion in revenue through 2026.

Nvidia’s meteoric rise — fueled by global demand for its AI chips — has made it the world’s most valuable tech company, surpassing Apple and Microsoft to become the first ever to close in on a $5 trillion market cap.