As the year draws to a close, investors are once again watching the so called Santa Claus rally, a seasonal market pattern that has long captured Wall Street’s attention and folklore.

An old Wall Street saying holds that “If Santa Claus should fail to call, bears may come to Broad and Wall.” The phrase reflects a belief that a weak year end could signal trouble ahead, though history suggests the indicator is far from a crystal ball.

The Santa Claus rally, as defined by the ‘Stock Trader’s Almanac’, consists of the final five trading days of the year and the first two trading days of the new year. This year, the window runs from December 24 through January 5.

What history shows

Despite its reputation, the Santa Claus rally has limited forecasting power for the year ahead. In the 14 years since 1969 when the S&P 500 posted negative returns during the Santa Claus window, the market finished the following year lower only four times, a hit rate of about 31 percent.

Still, Santa has historically brought cheer more often than not. Since 1969, the S&P 500 has risen an average of about 1.2 percent during the seven day Santa Claus rally period. That performance is stronger than the average return for eight of the twelve calendar months since 1950.

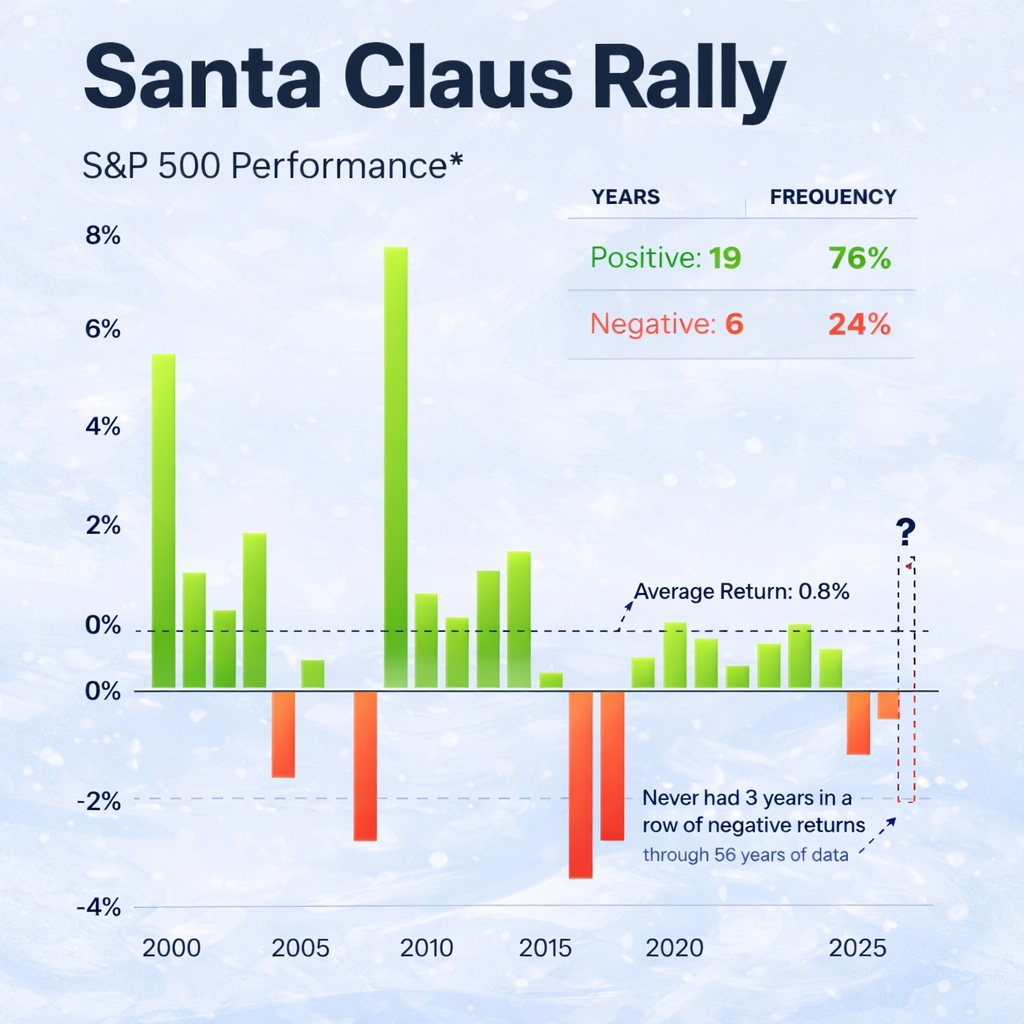

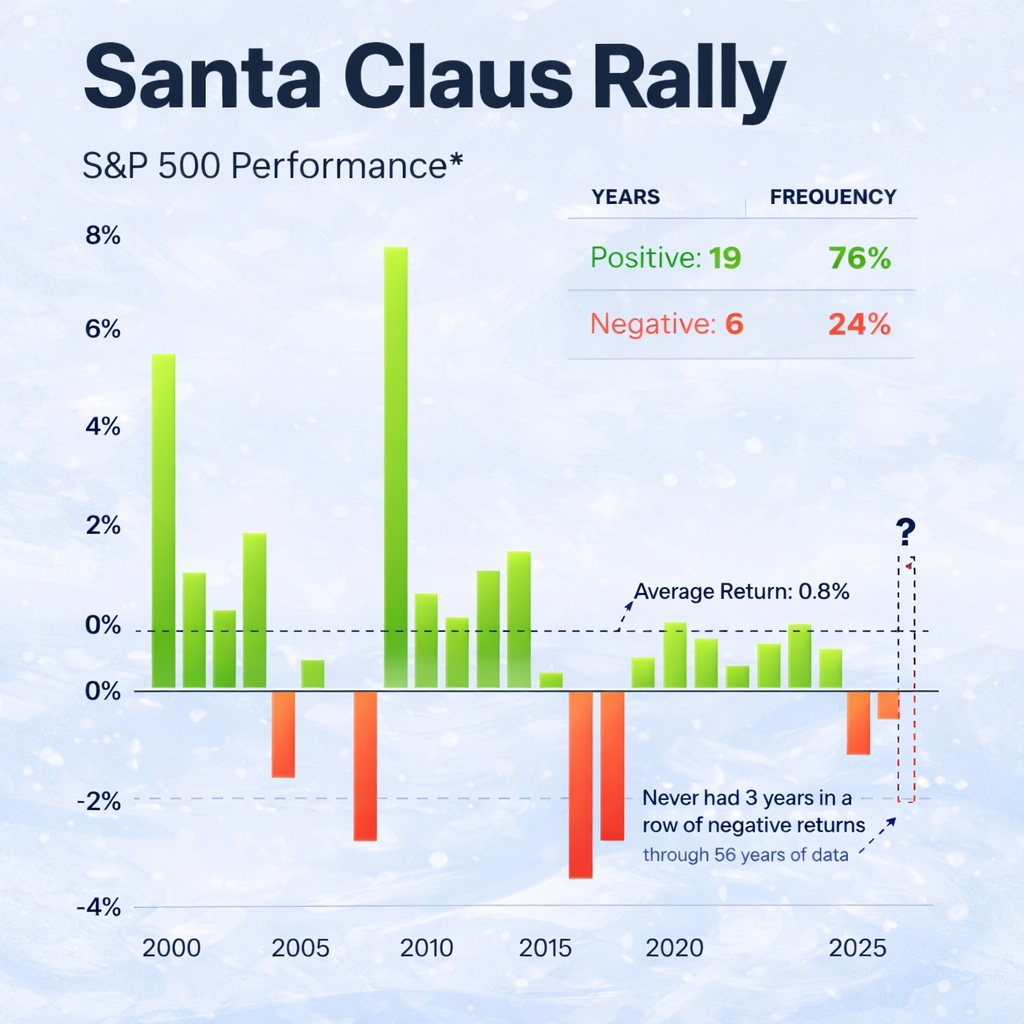

From 2000 through 2025, the index posted gains during the Santa Claus rally about 76 percent of the time, well above the typical success rate for a random seven day trading stretch. By comparison, according to Oppenheimer strategist Ari Wald, the S&P 500 rises only about 57 percent of the time over a standard seven day period, with an average gain of roughly 0.2 percent.

2 View gallery

From 2000 through 2025, the S&P 500 posted gains during the period about 76% of the time

December itself also carries a strong seasonal reputation. Historically, it ranks as the third best month for S&P 500 performance since 1950, reinforcing expectations for a late year lift.

A narrower window than many expect

The Santa Claus rally is often misunderstood as a broad year end effect. In reality, it is tightly confined to a short and specific window. Trading volumes tend to be lighter during this period, and investor sentiment often improves as calendar pressures ease, creating conditions that can amplify market moves.

Jeffrey Hirsch, editor in chief of the ‘Stock Trader’s Almanac’, has said recent market behavior fits the classic pattern. After a choppy start to December and a midmonth pullback, he said conditions appear aligned for a potential rally, even if gains have already begun to materialize.

Headwinds this year

Still, there are reasons for caution. The Santa Claus rally disappointed in both 2023 and 2024, years marked by unusually heavy concentration in the S&P 500’s largest stocks. In those years, returns during the Santa Claus window were negative, coinciding with some of the strongest performance contributions on record from the index’s top ten names.

Strategas data show that in 2025, returns through November again reflect one of the largest contributions from the top ten stocks in positive performance years since 1991. That concentration could make the rally more fragile if leadership falters.

History offers some reassurance even in weaker years. In the 14 years since 1969 when the S&P 500 finished the year lower, Santa Claus rally returns were negative only four times. In those down years, the median Santa Claus rally gain was about 1.3 percent, even as the median annual decline for the index stood at roughly 11.4 percent.

What it means for investors

While the Santa Claus rally may not reliably predict the year ahead, its presence or absence is still closely watched. A strong showing tends to reinforce bullish sentiment, while a failure can prompt investors to look more closely at underlying fundamentals, technical signals and market breadth.

For now, time will tell whether Santa delivers or whether holiday cheer fades. Despite recent disappointments, the odds historically favor investors staying engaged through the year end rather than stepping aside, even as risks around concentration and volatility remain firmly in view.