A wave of Israeli investors have fallen victim to an elaborate stock market scam—one that cost some of them hundreds of thousands. Launched quietly in April, the con was orchestrated through a highly coordinated campaign across social media, impersonating celebrities and trusted financial institutions from Israel and abroad.

Authorities say this is yet another chapter in the rising global phenomenon dubbed “the algorithmic scam”: a new breed of digital frauds powered by artificial intelligence and cutting-edge ad technology that target everyday users with alarming precision.

Part of the campaign

(Video: Social media)

Unlike traditional internet scams, this one played a long game—using a real company’s stock, legitimately traded on NASDAQ, to bait its victims. The recommendation to invest was spread far and wide via Facebook, Instagram, and WhatsApp, leveraging the platforms’ paid promotion tools. According to the Israeli Internet Association, those very tools have become “sophisticated and effective digital fraud machines” when exploited by malicious actors.

An AI-driven masquerade

This wasn’t the usual con. The fraudsters impersonated prominent tech and finance figures—among them Guy Rolnik, Eyal Waldman, “The Frugalist,” Shari Arison, and Tamir Mandovsky—as well as reputable institutions such as the Tel Aviv Stock Exchange, the Israel Securities Authority, Bank Hapoalim, Discount Bank, and Meitav Dash.

On Instagram, entire pages were built around deepfake videos. In one case, a synthetic clip showed Bank of Israel Governor Amir Yaron endorsing a bogus financial product. To enhance credibility, some pages posted legitimate-looking content before switching to the scam, building trust in their audience.

What made the scheme particularly convincing was the illusion of proof. The recommended stock actually did rise, and this was visible in real trading apps and banking platforms.

“The graph is real—it’s a screenshot from Google,” early reports noted. The deception was international in scope: scammers lured investors from multiple countries, inflating the stock’s value and lending credibility to their pitch.

Weaponized deepfakes and hyper-targeted messaging

The scammers went all-in on AI-driven manipulation. Dozens of deepfake videos were released, depicting well-known public figures like Amir Yaron, Prime Minister Benjamin Netanyahu, Eyal Golan, Noa Kirel, Gal Gadot, Elon Musk, and Mark Zuckerberg—all appearing to tout fake investment opportunities.

They customized the videos for different Israeli demographics, even adding subtitles in Russian, and timed releases to coincide with current events—making the content feel timely, local, and authentic.

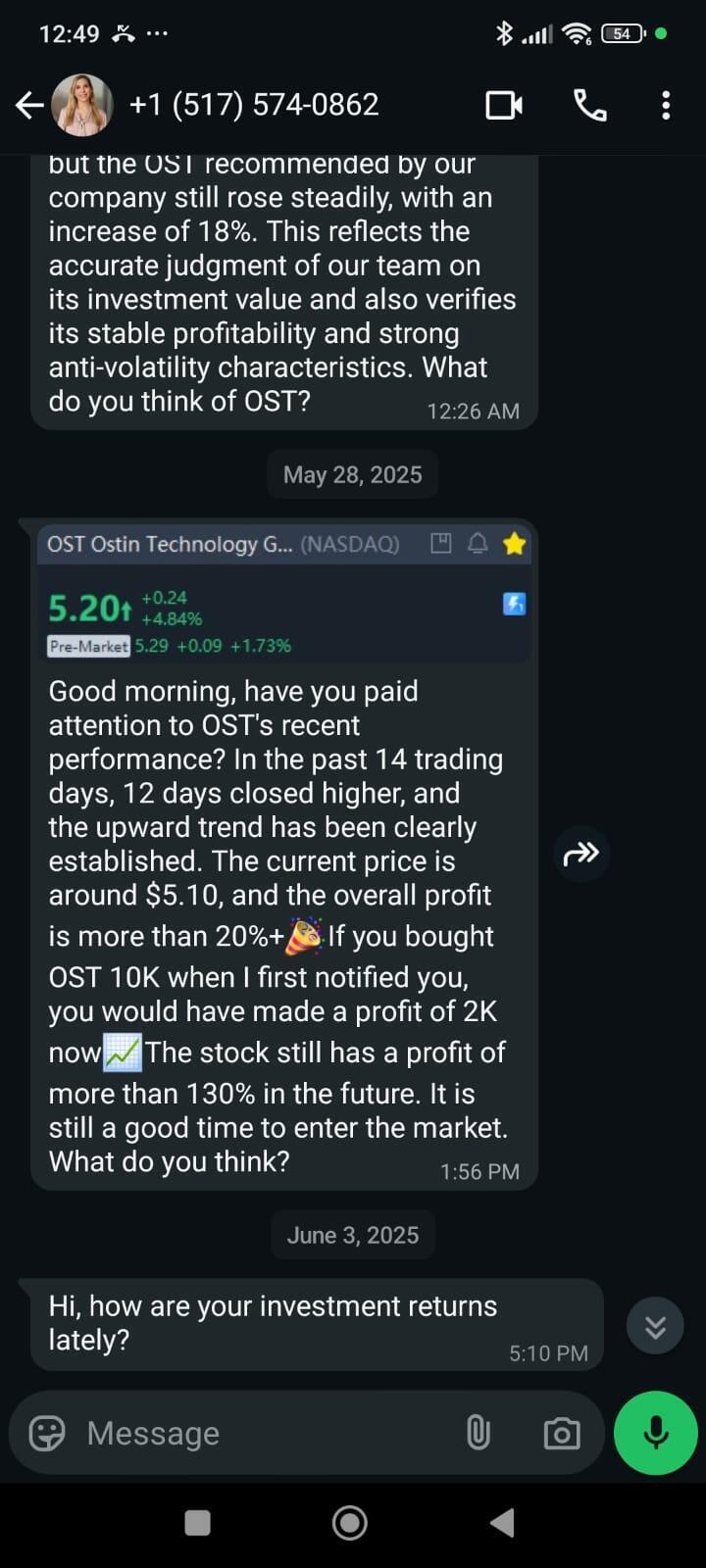

Meanwhile, a “pump” campaign was underway. Fraudsters maintained WhatsApp contact with victims, posing as financial experts, and created phony WhatsApp groups that mimicked successful investor communities. The goal was clear: to create a sense of exclusivity, belonging, and trust.

Clicking the ads led users to polished, external websites offering seemingly legitimate financial services. Once there, victims handed over their personal information and were introduced to a slick, but entirely fake, investment platform—complete with dashboards, graphs, and simulated market data.

The crash and the aftermath

According to the Safe Internet Helpline run by the Israeli Internet Association, the stock’s gradual rise in April was no accident—it was a scripted phase in a broader scheme.

“We and the investigators were aware it would crash, given the scam’s fabricated foundation,” they explained.

And crash it did. Over the recent weekend, the stock collapsed. Dozens of victims took to social media to report massive losses. In two severe cases, victims lost 250,000 and 150,000 shekels, respectively.

The stock at the heart of the scam—Ostin Technology Group Co. Ltd. (OST)—eventually plummeted, at one point trading for as low as $0.17, down nearly 93%.

Digital platforms under fire

The Israeli Internet Association points a firm finger at social media platforms, accusing them of enabling these scams by adopting powerful advertising tools without sufficient oversight.

Among the failures: dynamic ads that show scam content only after being clicked, opaque advertiser identities, ad approvals for deepfake political figures without disclosure, poor cross-ad tracking even after a takedown, and easy redirection to external scam websites.

Perhaps most damning: the platforms reportedly profit from these sponsored scam ads, giving them little incentive to prioritize anti-fraud enforcement.

They note the platforms’ failure to recognize early signs of malicious AI content, limited removals of isolated ads, and the lack of meaningful sanctions against accounts running scams. As a result, fraudsters are able to rebuild quickly and continue operating without disruption.

Meta’s selective moderation

Jonathan Ben-Horin, head of the Safe Internet Helpline, issued a sharp rebuke to Meta for its piecemeal approach to these scams.

“Since the start of the year, we’ve seen a sharp increase in impersonation reports involving known Israeli figures—mainly financial experts and authorities—used to promote scams via sponsored ads and fake WhatsApp groups in Hebrew.”

“Unfortunately, Facebook and Instagram have only removed individual posts while the scams keep coming in waves,” he added.

He went on to describe a pattern: “A coordinated ring of imposters operating from a shared playbook, with dozens of pages, recurring campaigns, and uniform messaging.”

Ben-Horin called on Meta to shift course: “Meta already has the tools to block unwanted activity—be it pornography, drug sales, violent content, or hate speech. It’s time for Meta to take a systemic and proactive approach to remove scam infrastructure and content based on field data and victim reports.”

Time for legislative backing

The issue doesn’t end with Meta. According to the association, Israel’s own regulatory environment is part of the problem. Weak oversight and poor enforcement capacity have left the country particularly vulnerable.

Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iNv

Authorities are actively pursuing those behind the fraud, while the association is working toward legislation that would force digital platforms to adopt greater transparency and accountability, bolster investigative capabilities, and epower specialized enforcement units.

Meta’s Response: “Fraud is a complex problem without a simple solution. We are committed to doing everything possible to prevent scams on our platforms, working in cooperation with governments, other tech firms, banks, and law enforcement worldwide. The claim that Meta allows scams for financial gain is simply untrue. We invest in teams and technology to detect scams and remove fake accounts. Our policies prohibit impersonation of public figures to mislead others, and we act to remove all content that violates this policy.”