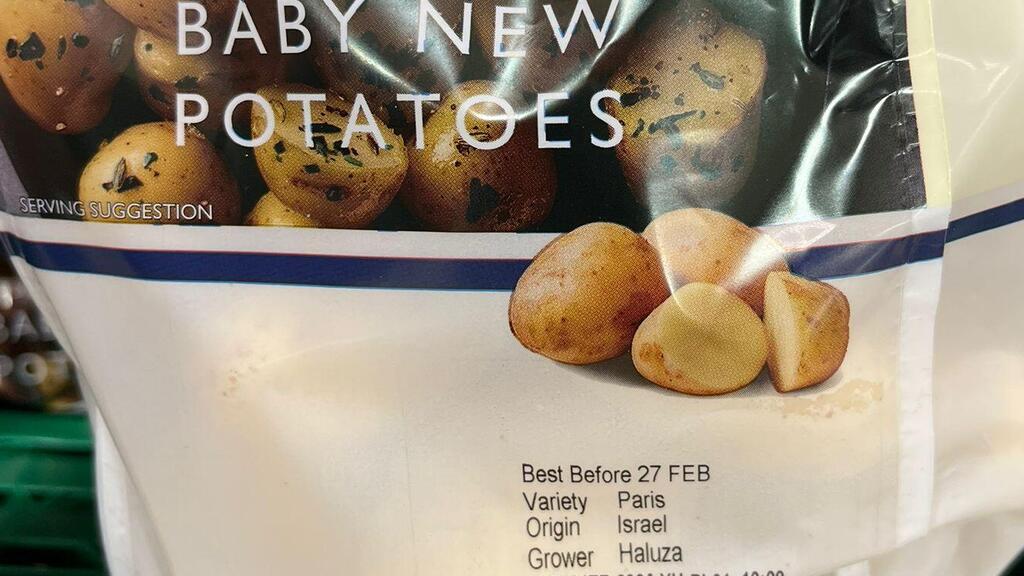

Following decisions by the Co-op chains in Italy and the UK to stop selling Israeli products, Israeli farmers and food exporters say they are seeing a growing boycott of Israeli agricultural goods across Europe, including in Germany. This country typically supports Israel and avoids overt boycotts. Behind-the-scenes pushback is also being felt from major retailers like the UK’s Waitrose, Germany’s Aldi and even as far away as Japan.

“In the past two weeks, we’re hearing louder voices calling for a boycott in Germany, and that’s new,” a potato exporter told Ynet. “For six weeks now, Aldi has been doing everything possible to avoid buying from us.”

Another Israeli farmer said: “We sell to packing companies, who then brand and distribute our products to the supermarkets. One of my German packers told me, ‘I love you guys, I need your product, I’ve known the Israeli farmers for years — but the retailer's buyer told me it’s hard to place 'Produce of Israel' on the shelf when the newspaper headline reads ‘genocide.’ It’s weighing on us.’ I understand them. Still, the Germans have stuck to their purchasing schedules — so far.”

Ofer Levin, an agricultural exporter, added: “There’s been a major shift in sentiment against us in Germany in recent weeks, driven by public opinion around the Gaza war. We’re nearing the end of our sales season there, and we’ve been subtly told that Aldi won’t carry us anymore. Officially, they say it's because there’s fresh local produce now, but when you dig deeper, it’s political. Aldi has decided to stop selling Israeli goods on its shelves.”

Belgium bans, Sweden long disengaged and Ireland joins in

Levin said the boycott began in Belgium, where EU labeling regulations require retailers to visibly mark the country of origin on shelves — something that has led to consumers rejecting Israeli produce. However, mini potatoes packaged in a way that bypasses country-of-origin labeling requirements continue to be bought in bulk. “That shows it’s entirely political,” he said.

Asked whether other countries are joining the boycott, Levin said: “In Sweden, ICA hasn’t bought Israeli produce for maybe five years. Norway doesn’t buy from Israel at all anymore. Since last year, the border has been effectively closed to our goods and this trend is growing across Europe.”

“The biggest customer for our potatoes is Germany,” he continued. “They’ve already told me: if this continues into next year, we might not be able to start the next season with you. And this is Germany — one of Israel’s more supportive countries.”

He exports to the German supermarket chain Kaufland, which gives him exclusive shelf space for two months annually. “I doubt they’ll drop us mid-season, but if the situation continues, they could easily decide to open the door to Egyptian produce. It’s not about quality — it’s political.”

“In France, Lidl canceled my program over the situation. France is a small market for us, but the political pressure is real. Public opinion matters.”

Even Japan is wary

A fruit exporter who supplies avocados, citrus and peppers — including to Co-op branches in Western Europe — said: “We’ve been hearing for a year that things are getting more complicated. It started under the radar but is becoming more overt as the Gaza headlines keep coming.”

Do you hear this across all your export markets?

“Yes — Western, Central and Eastern Europe, including Russia. Eastern Europe is less affected, and we also export to the U.S., Canada and even Japan.”

And what did you hear from Japan?

“A Japanese customer told us we should be cautious about shipping Israeli produce there — the perception of Israeli goods in Japanese society is becoming problematic.”

Yaniv Yablonka, CEO of Yapro, which exports around 50,000 tons of potatoes annually to 11 European countries, said Co-op is the only chain that publicly declares its boycott. “Most retailers tell packing houses privately: ‘Don’t bring us Israeli goods, we don’t want BDS trouble or protests — just get it from Morocco or Egypt.’ But Co-op is the only one that comes out and says it publicly.”

Yapro sells raw, unwashed produce to packers, who then clean, sort and brand it for stores. “After Operation Defensive Shield, we went to the Israeli embassy in London and made noise about the boycott, and Co-op backed down. Today, they don’t need us — they have alternatives. So it’s easier for them to turn against us.”

How the Co-op boycott unfolded

The renewed spotlight on the boycott came after Co-op UK and Co-op Italy announced they would stop selling Israeli products, including Achva tahini, SodaStream bottles and peanuts. Co-op Italy even began marketing Cola Gaza, a Palestinian-flag-branded cola.

Though the war in Gaza is the current trigger, Yablonka said the boycott had already begun beforehand. “I met with Co-op Norway’s buyer on October 5, 2023. Within two weeks of October 7, they canceled our deal. This isn’t new. It did not come out of the blue.”

Co-op Switzerland stopped buying Israeli goods five or six years ago, he added. “Every time there’s an operation in Gaza — Cast Lead, Pillar of Defense, Protective Edge — we face issues. This happens in Norway, the UK and Switzerland. Less so in Italy, where I work less.”

Worst markets for Israeli exporters

“I canceled all my seed orders for Belgium, Norway and Ireland on October 8, 2023. I knew the deals would fall through. In Norway and Belgium, those were big contracts. Ireland was smaller — maybe 500–600 tons out of our 50,000. But I know other exporters who got hit in Ireland, especially with citrus and radishes.”

Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iN

What about the rest of the UK?

“We had a relatively quiet 2024 and 2025 in the UK, until this past month. But in Ireland, we’ve seen BDS events, like dumping Israeli goods outside stores. In Norway last year, we didn’t sell a single kilo, even though they needed the product and asked for it. Packers told us: ‘We want your produce — the chains won’t allow it.’ In Belgium, the fear is about the EU labeling law.”

Even produce grown in southern Israel, far from the West Bank or Golan Heights, doesn’t always help. “I keep a ready-to-go file with UN maps, GPS coordinates and documents showing our goods are from sovereign Israel — but it only helps sometimes.”

Spain is still buying — for now.

What about Spain or the Netherlands?

“The Netherlands has issues, too — but they’re more business-focused. When there’s a supply gap, politics takes a back seat. Spain has been my biggest market for two years. Great deals for farmers. But I fear we’re on borrowed time.”

Why?

“The product is good, the chain is happy, but one day the buyer might wake up and tell the packer, ‘That’s it, no more Israeli goods.’ It’s in the air. Maybe the only reason we’re safe is because we sell in bulk, without labeled origin, so we’ve ‘removed’ the problem. But it hangs over all of Europe.”

Southern Israel growers hit hard, ships turning away.

Israeli potatoes are considered premium. “Tesco might carry 12–13 potato lines — we’re just one, priced at €700 per ton versus €200–300 for local options. We only sell from March to June, when old stock runs out and new harvests aren’t yet ready.”

But the war's effects go beyond politics. “Last Friday, during the Iran strike, a ship headed for Rotterdam and the UK abandoned its cargo in Ashdod and fled due to security concerns. And our growing region in the Gaza border region is operating at half capacity. Some growers have quit. The boycott might be the final straw — we’re an easy target because the product’s origin is front and center.”