The Knesset Finance Committee held a rare hearing Monday on whether the Bank of Israel is investing the country’s more than $220 billion in foreign currency reserves in the most effective way, with some lawmakers arguing the central bank should have bought more gold after prices surged to record highs.

The debate was sparked by claims that the bank missed out on major gains by not increasing its gold holdings. Gold prices climbed above $5,200 an ounce earlier this month before falling to about $4,674 by Monday afternoon, still up sharply over the past year.

Bank of Israel officials rejected the criticism, saying their investment strategy had delivered far better returns than gold. “The equities we hold have yielded up to three times more than gold,” senior central bank officials told the committee, adding that large-scale gold investments can be too speculative for state reserves.

The session, chaired by Hanoch Milwidsky of the ruling Likud party, was unusual as parliament has traditionally avoided intervening in the central bank’s reserve management, which has long been seen as professionally run. Milwidsky said the hearing was requested by several lawmakers after they felt their questions were not fully addressed in a previous session attended by Bank of Israel Governor Prof. Amir Yaron.

At the hearing, venture capitalist Liron Rose argued that Israel’s gold holdings are low compared to other countries with similar-sized reserves. “Japan holds about 7% in gold and the Netherlands about 70% — two extremes,” he said. “Poland holds around 28% and Turkey about 44%, each with roughly 600–700 tons of gold. Central banks globally are buying about 1,000 tons a year, including smaller countries. This is a matter of risk management, and it’s not only about gold. Some countries are even moving toward Bitcoin or other alternative assets.”

Dr. Golan Benita, head of the Bank of Israel’s markets division, countered that most developed countries hold gold for historical reasons dating back decades. “In recent years, it is mainly non-democratic states that have been buying gold — countries like Russia, China, Poland, Kazakhstan and North Korea,” he said, adding that many developed economies have been reducing their gold exposure.

Nir Hirschmann Rub of the Crypto, Blockchain, Web 3.0 Companies Forum urged the government to consider digital assets as part of its reserves. “If traditional financial systems collapse, a measured Bitcoin reserve could give Israel critical access to global capital markets,” he said. “The United States already understands this and is moving in that direction. Digital assets can preserve economic independence when conventional channels are blocked.”

Despite the debate, Milwidsky stressed that the committee has no authority to dictate investment decisions to the Bank of Israel, but said lawmakers still deserve clear explanations about how public funds are managed.

Vladimir Beliak, who represented the opposition at the hearing, said he did not believe the discussion was necessary. “This ties in with the finance minister’s call to cut interest rates. We need to preserve the Bank of Israel’s independence and its ability to conduct monetary policy,” he said.

“As for gold, contrary to popular opinion, I think it’s an asset that is rarely used. It’s true that it’s used for cables and jewelry, but it’s a speculative asset, and we saw that last Friday with its dramatic drop. It’s risky and would be difficult to liquidate if needed, so I disagree that the Bank of Israel should change its policy in this area.”

Milwidsky responded: “I asked the governor about this area and he gave me that answer. That is why I convened this discussion. The authority is to try to understand and discuss together, not to dictate, and we also cannot dictate to the Bank of Israel.”

Dr. Benita said that under the law, guidelines are to be set by the central bank’s Monetary Committee in consultation with the finance minister, and those guidelines are updated periodically. Benita defended the bank’s investment strategy, saying the choice of stocks over gold has proved most rewarding for the Israeli public.

He presented data showing that since 2012, equities have returned three times more than gold and stressed that gold is not as safe an asset as commonly believed. “Gold is not a solid asset; it’s volatile and no less risky than stocks, as we saw in its dramatic 20% drop in two days,” he explained.

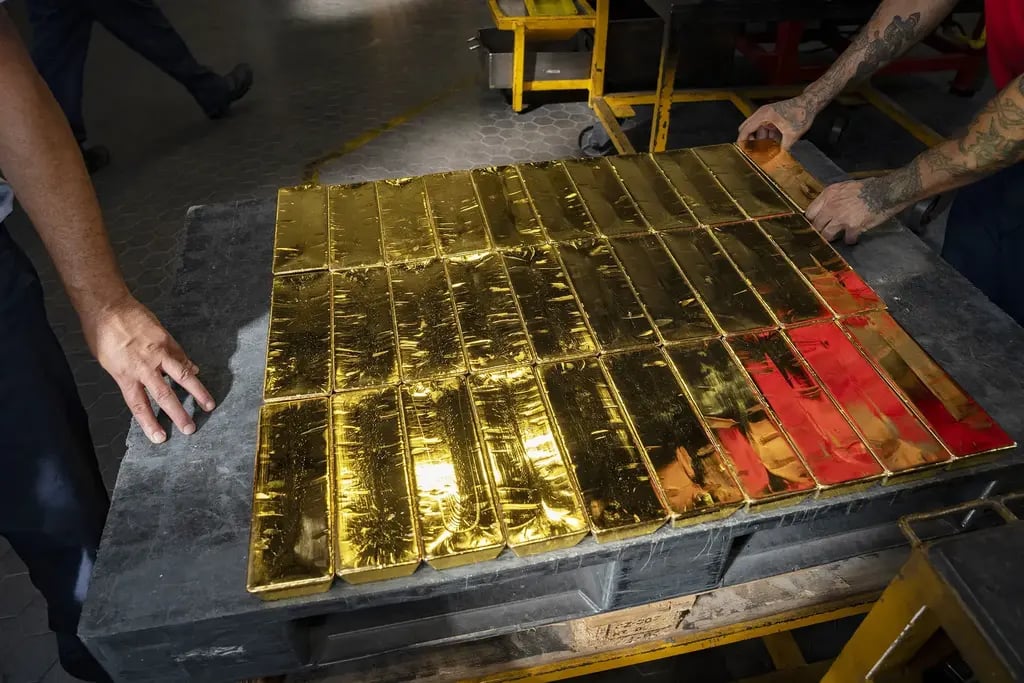

“While some countries hold gold for historical reasons, the Bank of Israel has chosen to manage risks actively and maximize the country’s wealth. Holding gold bars in vaults does not provide real protection against sanctions, since the ability to liquidate and sell them in a crisis is extremely limited.”

Benita concluded that the broad currency diversification and measured exposure to equities, at about 25% of reserves, place the Bank of Israel among the top central banks in the world in terms of performance and financial resilience.

Dr. Amit Friedman of the Bank of Israel said that dollar fluctuations are less relevant to Israel than gold price volatility is to gold holders. “The State of Israel must hold foreign currency. These are assets we are required to maintain. They have real purchasing power and serve both monetary and real policy goals tied to the reserves’ purchasing strength," he said. "I import goods in euros, Canadian dollars, U.S. dollars—so I hold those currencies. Part of the reserves' purpose is to enable such imports even in times of crisis. That’s why I’m indifferent to fluctuations in the reserves: they still allow purchasing power amid volatility.”

He emphasized that the central bank acts as a strategic investor. “We don’t move in and out of assets over the short term. We seek long-term horizons. We don’t enter a new asset class during a sharp rally because then you see what happened Friday. Gold is a risky asset, but we have better-performing risk assets.”

Bank representatives added that the Monetary Committee had already held discussions on gold and decided against buying it at this time. They stressed the need to understand the underlying reasons behind gold’s recent price spike. They pointed to the committee’s decision to invest instead in equities and corporate bonds and said that gold could be considered in the future.

“Over the past year, we were uncomfortable. Previously, for years, the share of reserves held in gold was virtually zero. Central banks just sat on their gold. Gold has lost its classic role as a dollar-backed reserve asset. It still has a role, perhaps even as a reserve asset in the future, but that depends on timing and portfolio balance. We’re not ruling it out,” a representative said.

“The purpose of this hearing was to understand—not interfere—why you chose a particular course," Milwidsky concluded. "So far, I haven’t understood why you excluded gold. It would have been helpful to see comparisons with corporate bonds, for example. I would appreciate receiving accurate data comparing corporate bonds and gold, as well as a gold-dollar chart—not because I think you're mismanaging, but because I’ve sat on various committees and heard things that later turned out to be completely wrong. I want to examine your reasoning process.”

In response, Bank of Israel officials said they would provide the requested data.