MyHeritage has hired Jefferies to lead a sale process valuing the company at about $1 billion. The genealogy services provider is controlled by private equity firm Francisco Partners, which is spearheading the move. The company operates in dozens of languages across more than 180 countries, with a business model based on premium subscriptions that allow users to build complex family trees.

MyHeritage has undergone several ownership changes. In February 2021, it was sold to Francisco Partners, whose Israeli arm is managed by former Alvarion CEO Eran Gorev. Alongside Francisco Partners, minority stakes in the company are held by the family fund of SAP founder Hasso Plattner and by investor Gigi Levy.

Founded in 2003 by Gilad Japhet, MyHeritage is considered one of the three dominant global players in the fields of family history and consumer genetics. Headquartered in Or Yehuda, the company serves more than 104 million registered users worldwide and manages a database of around 21 billion historical records. It was acquired by Francisco Partners in 2021 at a valuation of approximately $600 million.

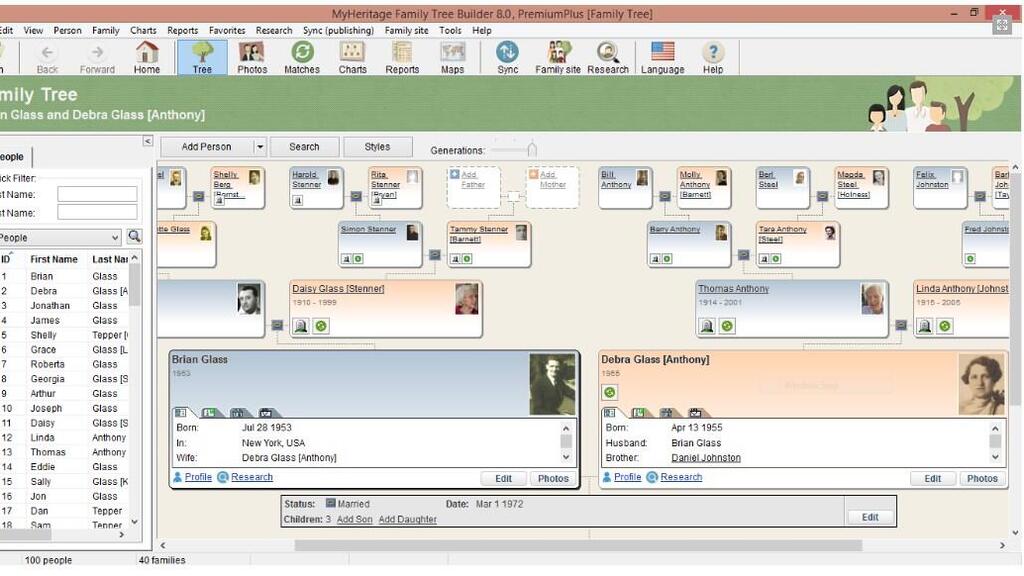

The company’s business model combines the sale of physical products with subscription services, generating revenue through two main channels: content subscriptions and DNA testing. MyHeritage sells annual subscriptions that grant access to extensive databases of birth and marriage certificates, census records and newspaper archives. It also sells at-home DNA testing kits, not only to generate direct revenue but also to incorporate users’ genetic data into its database, creating a network effect. Each new test increases the likelihood of identifying relatives for existing users, thereby enhancing the value of the service.

MyHeritage also offers free services, though these are limited compared to the features available to paying subscribers.

Shortly before completing its sale to Francisco Partners, MyHeritage launched a tool called “Deep Nostalgia,” which animates still photos. It later introduced “AI Time Machine,” a feature that creates historical-style avatars. These tools were designed to generate viral exposure on social media and attract younger users to the platform.

MyHeritage does not operate alone in the genealogy market. Its main competitor is Ancestry.com, while 23andMe previously posed significant competition as well. Ancestry is considered the world’s largest player in family genealogy, with a database of more than 25 million DNA samples and over 60 billion historical records.

23andMe, a pioneer in consumer genetic testing, has faced major difficulties in recent years. In June, it was sold back to its founder for $305 million as part of U.S. bankruptcy proceedings. Its market value had fallen to $13 million on the eve of the bankruptcy, compared with a peak market capitalization of about $6 billion in 2021. Its business model differs from that of MyHeritage, relying on DNA kit sales alongside partnerships with pharmaceutical companies for data analysis.