Members of Kibbutz Hanita near Israel’s northern border are demanding $11 million from Ballet Vision, the Chinese fund that controls 80% of the Hanita Lenses plant, accusing it of refusing to exercise an option to purchase the kibbutz’s remaining shares, according to a lawsuit filed in Tel Aviv District Court.

In a response letter attached to the lawsuit, the Chinese fund said that since the outbreak of the war in Israel, Beijing has classified Israel as a “high-risk area” and imposed a ban on any new Chinese investments in the country, making it impossible to carry out the option.

“Since the outbreak of the fighting in Israel, the Chinese government has classified Israel as a high-risk zone (red category) and prohibited any new Chinese investment in the country,” the fund wrote. “As long as this restriction remains in place, there is no practical operational ability to exercise the option.”

According to the lawsuit, in 2021 the kibbutz sold 74% of Hanita Lenses, which manufactures intraocular lenses for medical use, to Ballet Vision for $35 million. Of that sum, $25 million was paid to kibbutz members, with an additional $10 million injected into the company.

As part of the agreements, the Chinese fund granted the remaining minority shareholders an option to require it to purchase their remaining shares for about $9.5 million, now valued at roughly $11 million, by early December 2025.

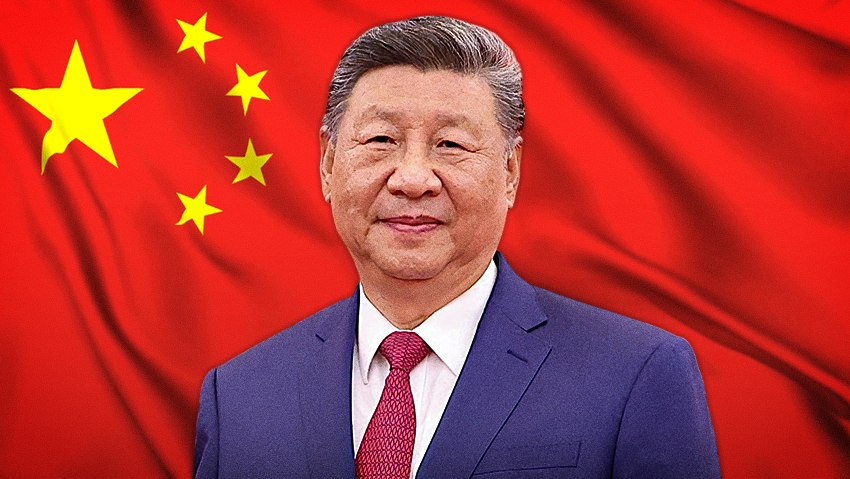

2 View gallery

Hanita Lenses factory: ‘The kibbutz has endured two very hard years, and the funds are needed for rehabilitation’

(Photo: Efi Shrir)

The kibbutz claims that its stake was further diluted in two subsequent agreements in 2022, leaving the Chinese fund with about 80% ownership. One dilution followed a $7 million additional investment, while another was tied to a future $8 million investment that has not yet been carried out.

In December, the kibbutz notified the fund of its intention to exercise the option. The lawsuit says the funds are urgently needed due to the war. Hanita, located close to the border, has endured two extremely difficult years, and the money is required for rehabilitation, particularly for older members.

The kibbutz also argues that it has been excluded from the company’s management, which it says is now run centrally by representatives of the Chinese owner, with the board no longer convening. Under these circumstances, it said, retaining shares has become “meaningless.”

The fund, however, cited two reasons for refusing to proceed: heavy operational losses and what it described as the Chinese government’s ban on investing in Israel since the war.

In a December letter, Liu Yuxiao, a Ballet Vision director and the plant’s acting CEO, wrote that the company had accumulated operational losses of about $15 million over three years and bank debt of roughly $4 million, leaving it in severe financial distress by early 2025.

Yuxiao said he took over as CEO in March 2025 in an effort to prevent bankruptcy and claimed the company is now on track to reach operational break-even this year. Still, he argued that discussions about the option are premature and could jeopardize the fragile recovery.

He also pointed again to political constraints, saying the Chinese government’s restrictions have forced the fund to rely on shareholder loans rather than fresh capital injections, limiting its ability to finance the company.