It is happening now, and it will grow to monstrous proportions in 2026 and beyond: The skylines of rural areas in Virginia, Indiana and even the deserts of Saudi Arabia and the United Arab Emirates are being reshaped. Not by new cities or traditional factories, but by the rise of so-called “silicon cathedrals” — enormous data centers built at an unprecedented pace to feed artificial intelligence’s insatiable demand.

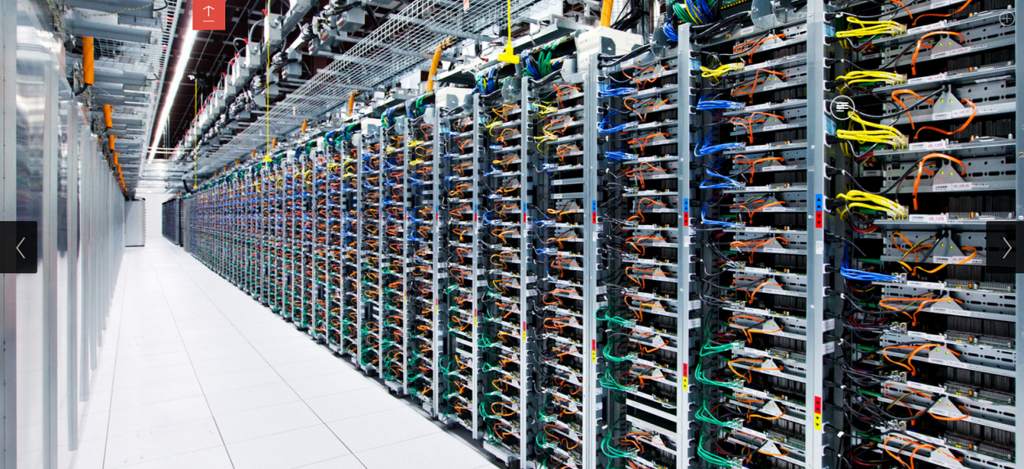

Beyond their sheer size, veteran Wired technology writer Steven Levy has described visits to data centers as an almost spiritual experience: vast, dimly lit halls filled with blinking lights and the constant hum of fans, evoking temple-like spaces.

The scale of investment is staggering. According to recent reports, major technology companies including Microsoft, Google, Amazon and Meta invested more than $450 billion in AI infrastructure in 2025 alone, with spending expected to exceed $500 billion in 2026.

What began as a basic need for cloud storage has turned into a global geopolitical and economic arms race, pitting multinational corporations alongside world powers competing for dominance. AI-era data centers are no longer standalone buildings, but sprawling campuses covering hundreds of acres.

'Could cover much of Manhattan'

The most ambitious project now underway is Project Stargate in Abilene, Texas, which will start at $100 billion this year and reach $500 billion over four years. Once completed, it will rank among the world’s largest computing clusters. The venture is a new joint company owned by OpenAI, Japan’s SoftBank, Oracle and Abu Dhabi-based investment fund MGX, aiming to build 20 massive data centers — eight in the United States and the rest abroad — along with supporting infrastructure for future AI breakthroughs.

Amazon, through its cloud unit AWS, plans to invest $150 billion over the next 15 years in similar facilities, including a $15 billion “AI factory” in Indiana. Microsoft said in early 2025 it expects to invest about $80 billion in data centers, while Meta plans up to $65 billion in AI projects, including a facility it says "could cover much of Manhattan.” Google’s data center in Iowa is already among the world’s largest, but some sites planned for 2026 are expected to be even bigger, consuming electricity comparable to a nuclear reactor or a mid-sized city.

The facilities require vast tracts of land and unusually high ceilings for liquid cooling systems, needed because AI chips — most commonly Nvidia’s H100 and Blackwell processors — generate heat beyond what traditional air cooling can handle.

After chips, water is the costliest resource. An average AI data center consumes about 5 million gallons of water a day, roughly the daily use of a city of 50,000 people. In drought-hit regions such as Arizona and Chile, data centers are increasingly seen as a threat to agriculture, with wells depleted or rendered undrinkable.

Global electricity use by data centers is expected to double by 2030 to about 1,000 terawatt-hours, potentially forcing governments to revive coal plants or extend the life of aging nuclear reactors, undermining carbon-reduction goals.

While governments including those of the United States, Saudi Arabia and the United Arab Emirates view the investments as strategic assets, local opposition is growing. In Virginia’s Prince William County, residents have protested a “data center corridor,” citing constant noise and damage to the historic landscape. In the Netherlands, farmer and environmental protests led to the cancellation of a major Meta project in the town of Zeewolde over concerns about agricultural land.

Communities near construction sites also report traffic congestion and rising accidents. In Richland Parish, Louisiana, home to Meta’s $27 billion Hyperion data center, traffic accidents rose 600% this year.

As a result, CEOs including Sam Altman, Satya Nadella, Sundar Pichai, Mark Zuckerberg and Larry Ellison — all convinced these data centers underpin the future global economy — will have to confront mounting challenges tied to natural resources and climate, even as they race to advance their technologies. Chipmakers, led by Nvidia, will also face a choice between pushing performance and addressing their soaring energy demands.