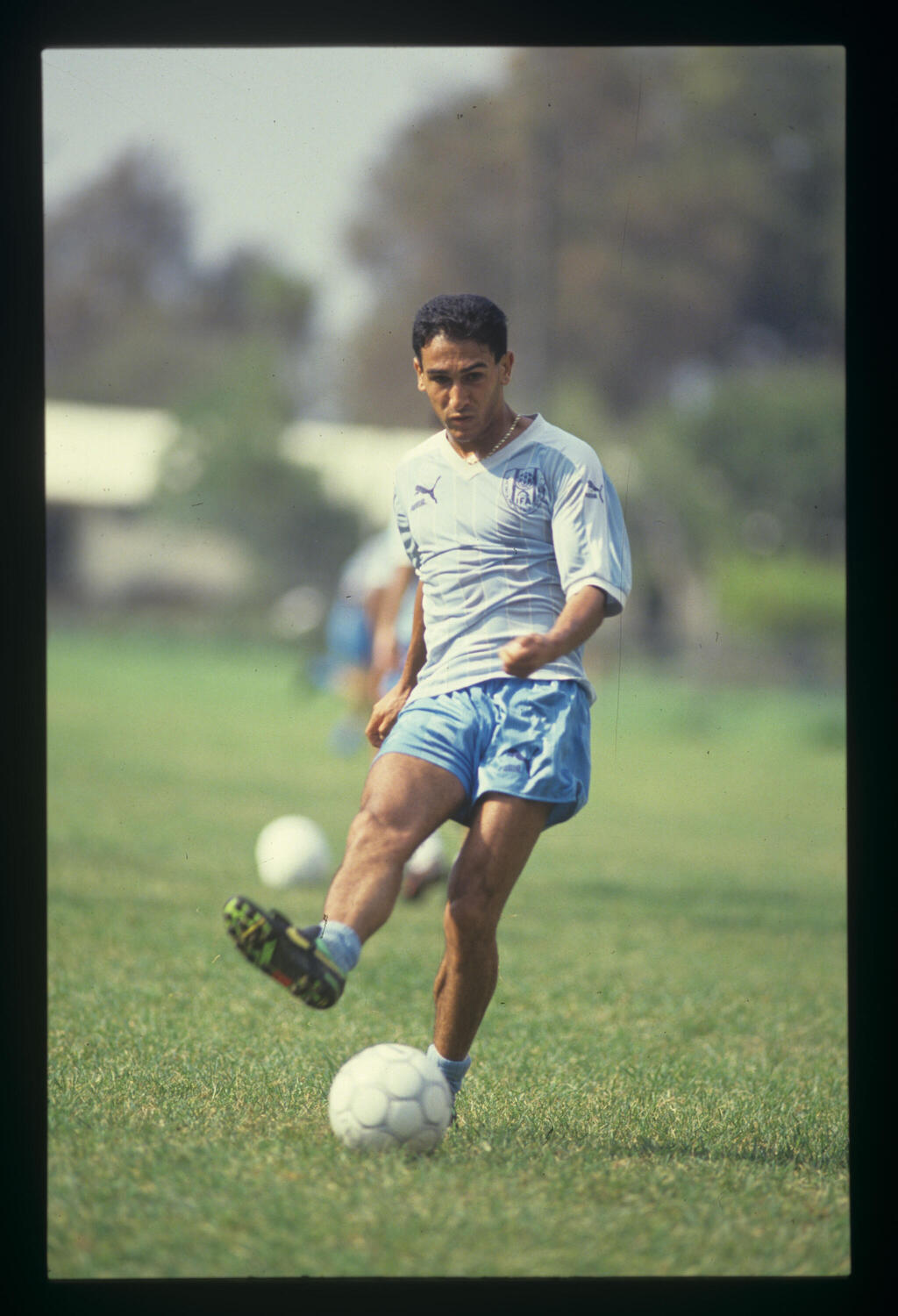

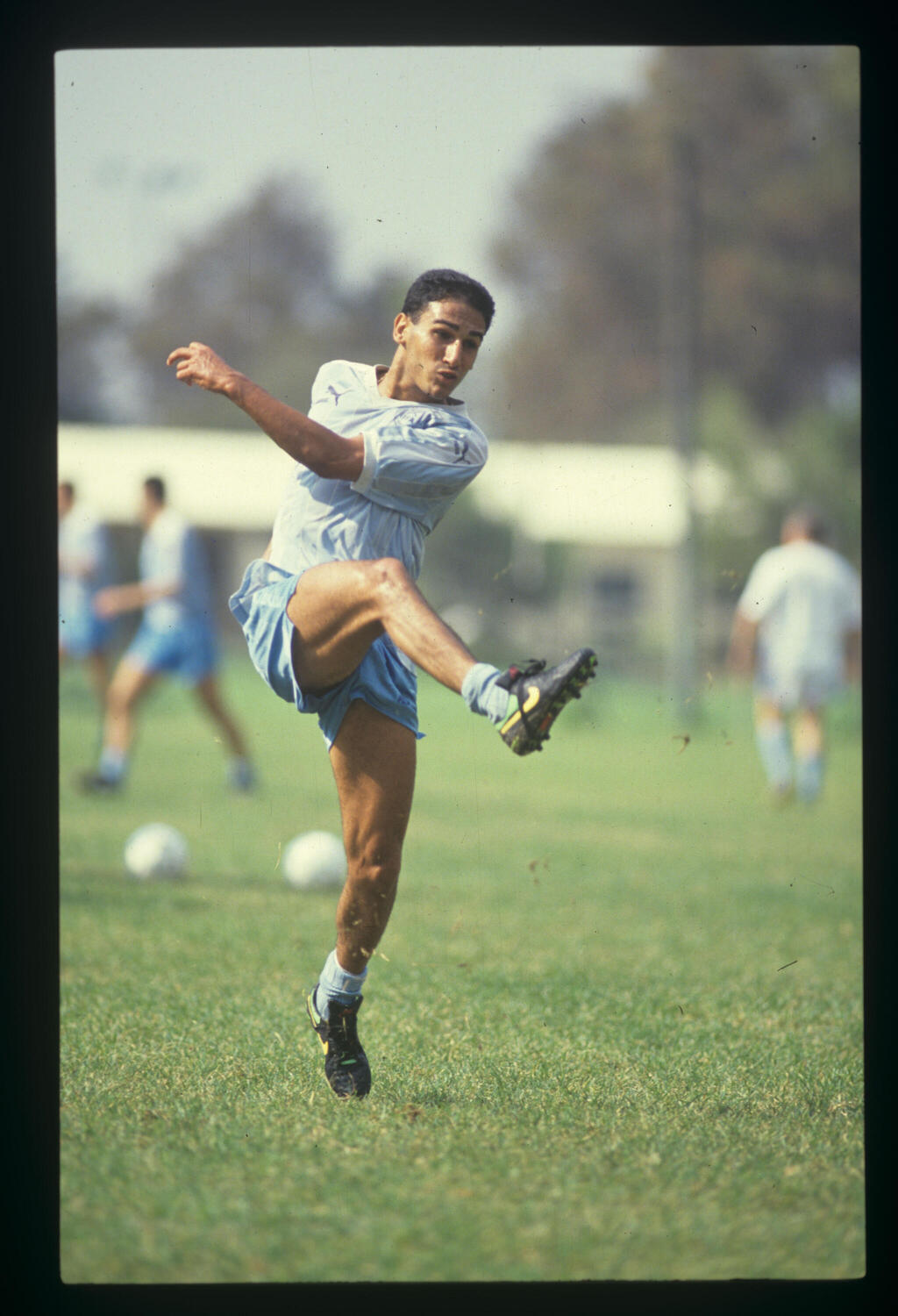

Sometimes, one unexpected moment in life changes everything. That’s what happened to Yacov Peled, until recently deputy CEO and head of the retail division at Bank of Jerusalem, about 35 years ago, when he was 20. Back then, he was a promising youth forward at the Beitar Jerusalem soccer club, marked as one of the club’s great prospects.

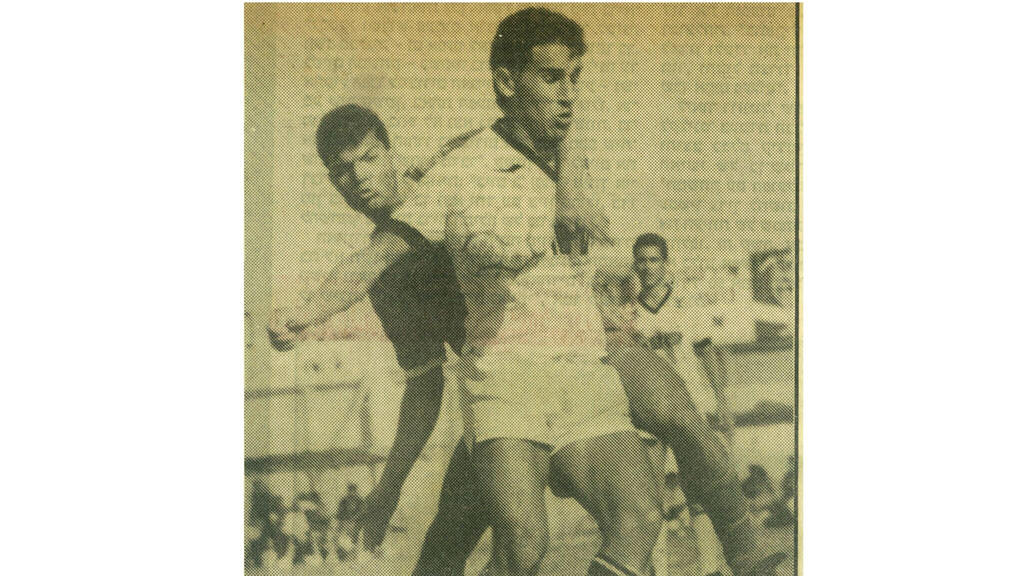

“We were playing Maccabi Netanya,” Peled recalls. “I was at the peak of my fitness and didn’t think anything could stop me. I had the ball, and Slobodan Drapić — who today coaches in the Israeli Premier League — went in for a slide tackle. My ankle stuck in the turf, my whole body twisted, and I felt the sky fall on me. Maccabi Netanya’s doctor ran out to me, put my ankle back in place and I was rushed by ambulance to the hospital. I went through three surgeries, but after about eight months, it became clear the injury ended my soccer career; it cut my dream off.”

What then felt like the end of the world for him ultimately led to a thriving career at the top of Israel’s banking and finance sector.

Peled, 55, grew up in the moshav Mevo Beitar in the Jerusalem hills. His parents, immigrants from Tunisia, were farmers and raised five children. He lives in Reut, is married to Limor, an attorney who heads the civil division in the State Attorney’s Office, and is the father of three daughters.

“I had an amazing childhood and supportive parents,” he says. “When I was 11, I started playing for Beitar Jerusalem. My whole life was geared toward becoming a professional soccer player. I’d leave at 7 a.m. for training and get home late at night hitchhiking. I attended school but didn’t finish my matriculation exams. Soccer is a world of sacrifice, and I felt I had to match those demands. My parents wanted me to study, but they understood and supported me. I integrated into Beitar; we were an excellent team, with the legendary Uri Malmilian, Avi Cohen and others. In the 1988–89 season, we also won the State Cup.”

He started the season on the bench, but in his first start, he was in the lineup for a top-table clash with the then-leaders Beitar Tel Aviv at Ramat Gan Stadium. In that match, which Jerusalem won, he scored a goal that went down in club lore: he took a dazzling slalom past three players, beat the goalkeeper and rolled the ball in. “Dror Kashtan, the late legendary coach, gave me a chance and I grabbed it with both hands. To this day, people remind me of that goal.”

That spectacular performance earned him a place on the Olympic national team and two successful seasons with Beitar, and it seemed Peled was on a fast track to becoming a local soccer star. But then Drapić arrived and turned his world upside down.

“After eight months of treatment, I tried to come back, first at Beitar and then at Hapoel Kfar Saba and Ness Ziona, but I ran into physical and mental difficulties,” he says. “I couldn’t get my career back on track. I was 22, and when I realized I couldn’t return to being the star I was, I made the very hard decision to retire. It was a big crisis. My family never stopped supporting me, but it was hard to internalize that everything I had built through such hard work was gone.”

He hung up his boots, recalculated his course and decided to pursue university studies. After finishing his matriculation exams and a university preparatory program, he was accepted to the Hebrew University of Jerusalem, earning a bachelor’s degree in economics and accounting with honors and a master’s degree in business administration.

He began his professional career as an auditor at Kesselman & Kesselman, PwC. From there, he held management roles in the Banking Supervision Department at the Bank of Israel. He then spent eight years at Discount Bank as head of risk management and later head of commercial banking. In 2019, he was appointed credit vice president at CAL (Israel Credit Cards Ltd.), and from 2022 until he announced his departure, he served as deputy CEO and head of the retail division at Bank of Jerusalem.

“As the 11-year-old I was, soccer was first, second and third,” Peled says with a laugh. “A bank wasn’t in my top ten. As a child, as a teen, as a young man, I marched toward the dream of being a leading player for the club and the national team. Then the traumatic injury came, and when I realized I couldn’t return to what I was, I decided to sever ties completely from soccer. I disconnected from friends and from the pitch, and since then I haven’t been to any soccer match.”

Why such an extreme break?

“I felt that the aggressive, tough world of soccer belonged to the past and I began to build a ‘new Yacov,’ one that was 180 degrees different from the old Yacov. I felt that was what I needed to build something new. At that time, I had many moments of insecurity; I didn’t believe I could make the turnaround. Only after I completed my matriculation and was accepted to university did I begin to believe in myself again. I realized I could succeed in studies and in the new world. The break was so sharp that I didn’t even list being a soccer player on my résumé; I felt it didn’t add value and I didn’t want that stigma.”

'Creating a real level playing field in the system'

“My approach is that you must keep moving and seize opportunities,” Peled says, drawing the obvious parallel between soccer and business. “Some succeed and rest on their laurels, but to me, the wisdom in both soccer and business is to dare, to initiate, to attack, to play forward, to be effective in execution. Playing wide or staying on defense is not effective. You have to work with a finishing foot. When the ball reaches the box, you have to put it in the net. That’s the message I tried to instill in employees wherever I managed.

“Another commonality between soccer and business is the need to be a team player. There are employees and management members and you need to work with them without losing your qualities and uniqueness. There’s a phrase that talent can win a game, but only a team can win a championship. That reflects my vision in business as well: mobilize people, give credit and know how to support others when you lead.”

You began as an auditor and moved into banking. Why?

“My work as an auditor helped me understand accounting lingo and culture, and that has stayed with me. But in 2002, after the failures of two banks — the Commercial Bank of Israel and the Industrial Development Bank of Israel — I was fascinated by banking supervision. On a personal and Zionist level, I wanted to help preserve banking in Israel. The subprime crisis in 2008 also gave me a solid foundation to cross over.

"I first crossed over when I started working at Discount Bank under Yair Avidan, who later became the banking supervisor. After about five years at Discount, I was appointed head of the commercial division and managed activity with medium-sized businesses whose annual turnover exceeded 10 million shekels. There, I felt the economy, the industry, trade, real estate; I accompanied people who built their businesses with their own hands. From then until my last post, I served in the banking system and enjoyed every moment.”

Then, this past July, after three and a half years in the role, you announced your retirement.

“That’s right. I decided that at my age, I still have much to offer. After Chapter A of soccer and Chapter B of finance, I’m beginning an independent, interesting and challenging Chapter C. I’m in a cooling-off period, building myself for the new chapter. I’m aiming at advising banks that want to improve or credit card companies that want to become banks. My vision is clear: Israeli banking can be more competitive. The time is ripe for new players to enter the banking field to increase competition."

Why do you think you are suited to that mission?

“My advantage is that I’ve seen everything in the banking system, all roles and systems, and I know the 360 degrees of the financial world from both the office and the field. I take everything I learned in soccer and in the banking system to create value advising certain companies.”

Israel’s banking system today shows stability and high profitability compared with the past and with most OECD countries. Where is the problem?

“The problem lies in competition and in the prices customers pay for services. The necessary step is removing barriers and granting what I call ‘baby protections’ to allow entry of credit card companies and nonbank lenders into the banking system, a move that would create disruptive competition and change the rules of the game. Adding players to the banking field will shift non-interest-bearing current account balances to deposits and increase competition in credit, especially for households and small and medium businesses. The current banking supervisor, Daniel Hahiashvili, attributes great importance to increasing competition and admitting additional banks.”

What are the advantages of turning a nonbank credit company into a small bank?

“Allowing credit companies to become small banks and gather public deposits would create significant competition in deposits and allow those companies to save substantially on funding costs. Such a move would reduce dependence and the funding risk that credit companies currently have with the banking system.

"A second advantage is the ability of credit companies to grow by increasing leverage. By becoming small banks, they could double their loan portfolios on the same equity, and that is important for increasing competition in credit to small and medium enterprises, especially in real estate. Other advantages of moving from a credit company to a bank are strengthening the brand, increasing public trust, better credit ratings and greater access to debt and equity.”

How, in your view, can nonbank credit companies be encouraged to seek licenses as small banks?

“Supervision should continue to support product diversification so customers have tools to manage their current account at a commercial bank while easily consuming bank-like services elsewhere, particularly credit and deposits from other entities, especially small banks. In addition, there are unique features of credit companies that require further regulatory relief, such as concentration limits by sector and liquidity rules. Most credit companies are concentrated in real estate, so it’s advisable to adopt additional regulatory easements similar to those that exist in the U.S. for small banks.

“I think that to accelerate the move, the Banking Supervision Department should also promote public deposit insurance for banks, similar to the model in the U.S. Such a step would be a true leveler and speed the increase in competition because it would allow small banks to significantly expand their potential customer base and lower interest costs by reducing the small bank’s risk premium.

"In my view, the credit companies that prepare for the expected change before applying for a license as a small, lightly regulated bank will fare better and be in a better starting position and competitive advantage relative to other credit companies. This is a strategic opportunity that may not return, and the success of the current move to increase competition in the banking system will first be measured by the number of credit companies that join the banking system.”

And why would incumbent banks accept this move rather than trying to block it?

“In my view, the banks shouldn’t oppose such a move. Faced with the legislative cloud that may force banks into intervention on fees or into more dangerous interest-rate controls, this is the lesser of evils for them.”

This week, entrepreneur Nir Zuk announced that the new digital bank he founded, Esh (Hebrew for “fire”), will begin operations in 2026 with a range of customer benefits. Add to that the digital bank One Zero, which was established about four years ago. Where do you stand?

“In general, I believe in competitive evolution, not revolution, in a gradual developmental process, not abrupt drastic changes. In my view, increasing banking competition will lead to a revolution of credit card companies and lenders becoming banks, and less to the establishment of many new banks. Alongside that, it is important that Esh or other fintechs provide advanced banking technology and create value as bank-as-a-service platforms for various financial players. That’s a competition-creating event.”

The AI revolution has also taken hold in banking customer service and has led to technological replacement of human response. As someone who has accompanied business clients, do you support that?

“The more retail the activity and the larger the volumes, the more important personalized banking support becomes. In places where excellent businesspeople go in the wrong directions, an objective relationship manager steps in who looks after both the businessperson and the bank. I’ve always seen clients as partners because guidance and good advice help both clients and the bank. At large scales, AI does not replace human response but is a decision-support tool.”

What has the war done to banks?

“The last three years and the war were a challenging period. The sharp rise in interest rates and an ongoing war can devastate households and businesses. Many private and business customers needed support, and the wisdom of good bankers is knowing how to help those who need it. Customers are not suckers; they know and understand that they need the banker even in turbulent times. That was my guiding light throughout the period.”

What do you think about the especially high sums paid to senior bank executives in Israel?

“We recently passed a law capping senior pay at banks, insurance companies and the financial sector. Compensation in the banking system is not particularly high and there are no outliers compared with places not covered by the law. The banking system must continue to improve efficiency and service, but executive pay is not excessive.”

Do you think you’ll go back to watching soccer?

“I don’t think so,” he answers without hesitation. “By nature, I’m more active than passive; psychologically and physically, I’d rather do sports than watch. Over the years, I keep up with sports and I do a lot, for example, I do triathlons. Still, when I watch a soccer match, I return to that time and think I should have been there, and that was brutally cut in one blow. Today I’m in a complete place in my life; I don’t feel the need to go back.”

First published: 17:04, 09.18.25