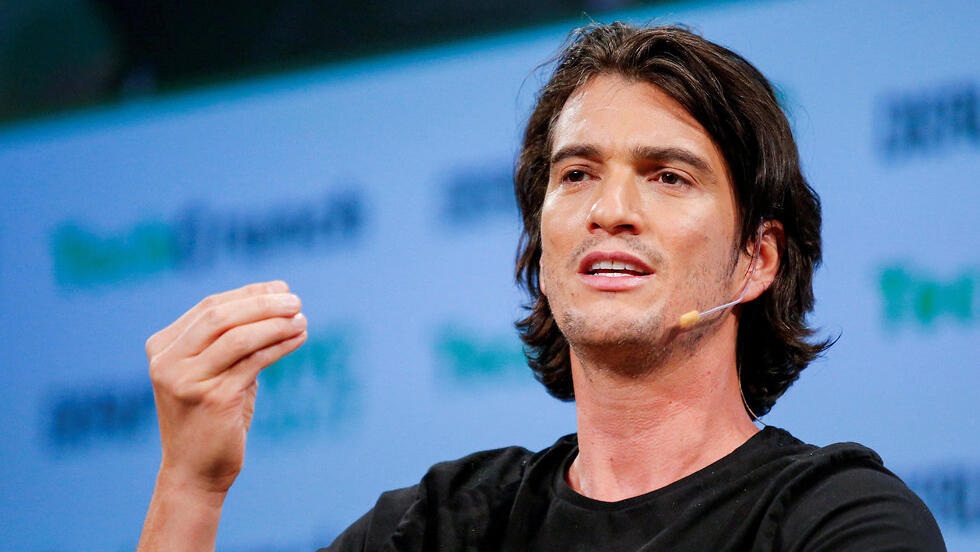

In 2019 Adam Neuman was extremely successful. He was head of WeWork, one of the highest valued startup companies in the world at the time, and was about to take the company to the public market - before it all came crashing down.

IPO paperwork that revealed WeWork under Neumann's leadership was managed without a clear business plan, and suffering great losses, partly due to investment in odd businesses, such as a private school headed by his wife, Rebecca - representing a conflict of interest.

Neuman, 43, earned a reputation of an eccentric entrepreneur who enjoys wild parties. One scene in the Apple TV show recounting the company’s story, WeCrashed, shows Neuman pouring drinks for his co-workers having just fired numerous employees.

In another incident, reported by the Wall Street Journal, Neuman and his friends hid marijuana inside of a cereal box on a private plane they were taking in from the U.S. to Israel. Upon discovering this, the jet’s owner quickly ordered the plane to return to the U.S. out of fear the Israeli officials will find the drugs, causing an international incident.

Neuman’s success story ended in September 2019, when he had to cede control of his company after failing to take the company private, thus losing the trust of his investors. Since 2019, he has kept a low profile - until now.

Firsts indications Neuman may be back business came in January 2022, when it was reported he bought 4,000 apartments across the U.S, worth total of 1 billion dollars. He told people close to him he intends to open a business, which will revolutionize the real estate market.

Four months later, Neuman and his new company FlowCarbon announced plans to fund a 70-million-dollar blockchain platform to allow businesspeople and enterprises to purchase carbon credit. One of the major investors in the company was Andreessen Horowitz, a private American venture capital giant, which is highly active in the cryptocurrency market.

The New York Times said Andreessen Horowitz invested 350 million dollars in Neuman’s new startup company, called Flow, despite the firm being in its initial stages of development. In the past, Andreessen Horowitz also invested in Facebook, Twitter, Instagram and others.

It’s still unclear what business plan Flow wants to follow when it launches in 2023. Mark Andreesen, co-founder of Andreessen Horowitz and a Flow board member, said the startup wants to tackle burning issues in the real estate market.

"Adam is a visionary leader who revolutionized the second largest asset class in the world — commercial real estate — by bringing community and brand to an industry in which neither existed before," Mark Andreessen of Andreessen Horowitz wrote in a post on Monday.

"We think it is natural that for his first venture since WeWork, Adam returns to the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes. Residential real estate - the world's largest asset class - is ready for exactly this change," Andreessen wrote.

Neuman had attempted to work with real-estate in WeWork’s WeLive initiative, in which he constructed coed living complexes, but the project was shut down after Neuman left the company.

Not everyone is happy with the entrepreneur's return to business, however, given his scandalous exit.

“The historical amount of money given to a man who is known to do business unethically, leads to emotional reactions,” said Allison Byers, founder and CEO of Scroobious, which assists startup companies who struggle to get funding. “Every other person needs to meet impossible standards [to get funding]. That’s where the anger is coming from.”

Leslie Feinzaig, founder and manager of Graham and Walker venture fund, who invests in female-operated startup companies, said Neuman being able to attract such a large investment comes as a shock. “I wish that women would receive the same opportunities to fail spectacularly like Adam Neuman,” she said.

One of the highlighted Twitter posts about Neuman, compared him to Elizabeth Holmes, founder of the Theranos startup company, who was convicted on criminal fraud charges and may be sentenced to 20 years in prison.

"The man is clearly a great salesman and he knows how to create a clear narrative and vision. He raised a lot of money for WeWork,” said John Drachman, co-founder of the Waterford Property Company.

"Only time will tell if this will be another WeWork.”