The holiday season in the United States is usually the busiest time of year for the American tourism industry. Families reunite from coast to coast for Christmas under the Christmas tree or for Hanukkah by the light of the menorah.

And of course, there are also those who prefer to use the break to go on vacation overseas. Many of them set their sights on a visit to the Holy Land—namely, Israel. It is one of the preferred destinations for many devout Christians who each year make pilgrimages to Jerusalem, Nazareth, Capernaum, Bethlehem and other landmarks connected to the life of Jesus.

But whether Catholics, Evangelicals, Jews or members of other faiths, travelers planning to visit Israel this year as pilgrims or as independent tourists face difficulty finding coverage on Squaremouth, the leading online marketplace in the United States for travel insurance.

Searching on Squaremouth for travel insurance to Israel during the holiday season (December–January), or at any time, yields only a handful of plans, offered by insurers such as IMG, WorldTrips, Nationwide and HTH Worldwide. This, despite the site featuring more than 20 leading insurance providers in the U.S. and worldwide, among them Generali, Tin Leg, Berkshire Hathaway and Travelex. In short, there are hardly any insurers offering their services to customers interested in traveling to Israel for Christian holidays, or at all.

Squaremouth aggregates a wide range of travel insurance options for American and international customers seeking coverage against any mishap that might occur during a vacation in the United States or abroad, and presents users with the full range of policies offered by different insurance companies. Yet, for the site’s many customers - an estimated 4.3 million in 2025 - the website offers virtually no insurance options for trips to Israel.

And as if the limited search results weren’t enough, most companies clearly state in each policy that it does not include travel to Israel, even if the coverage is intended for travel in Europe or the United States.

5 View gallery

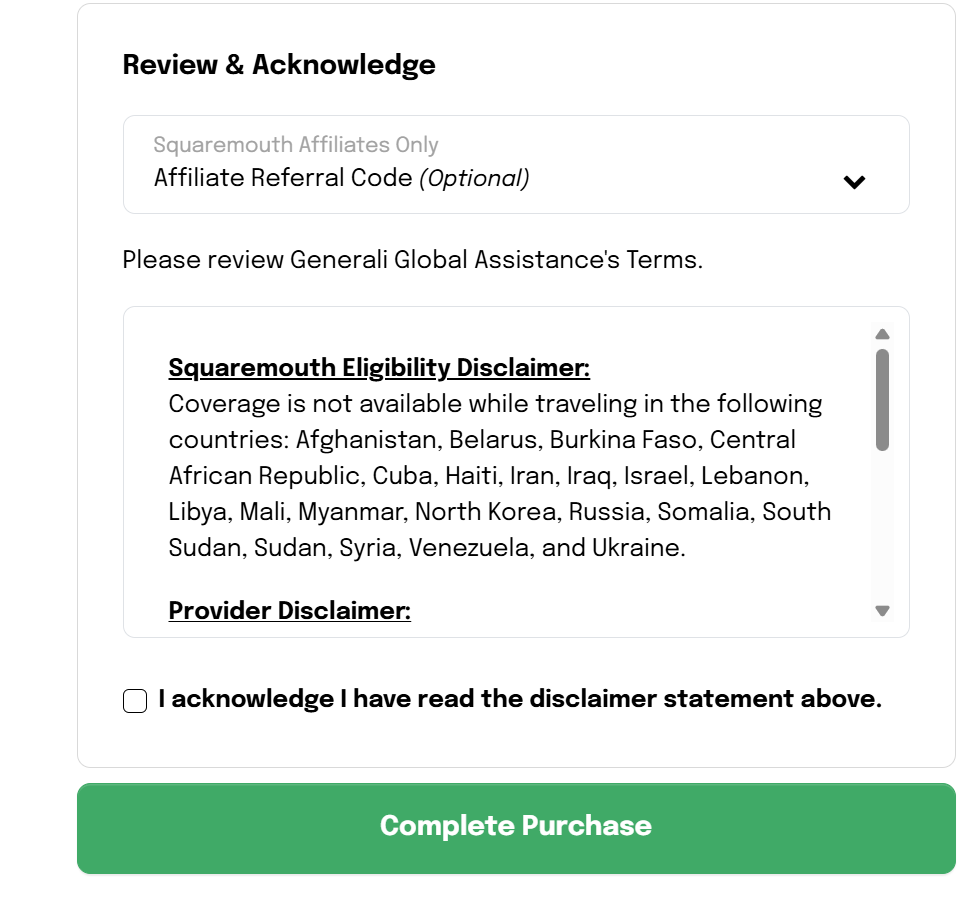

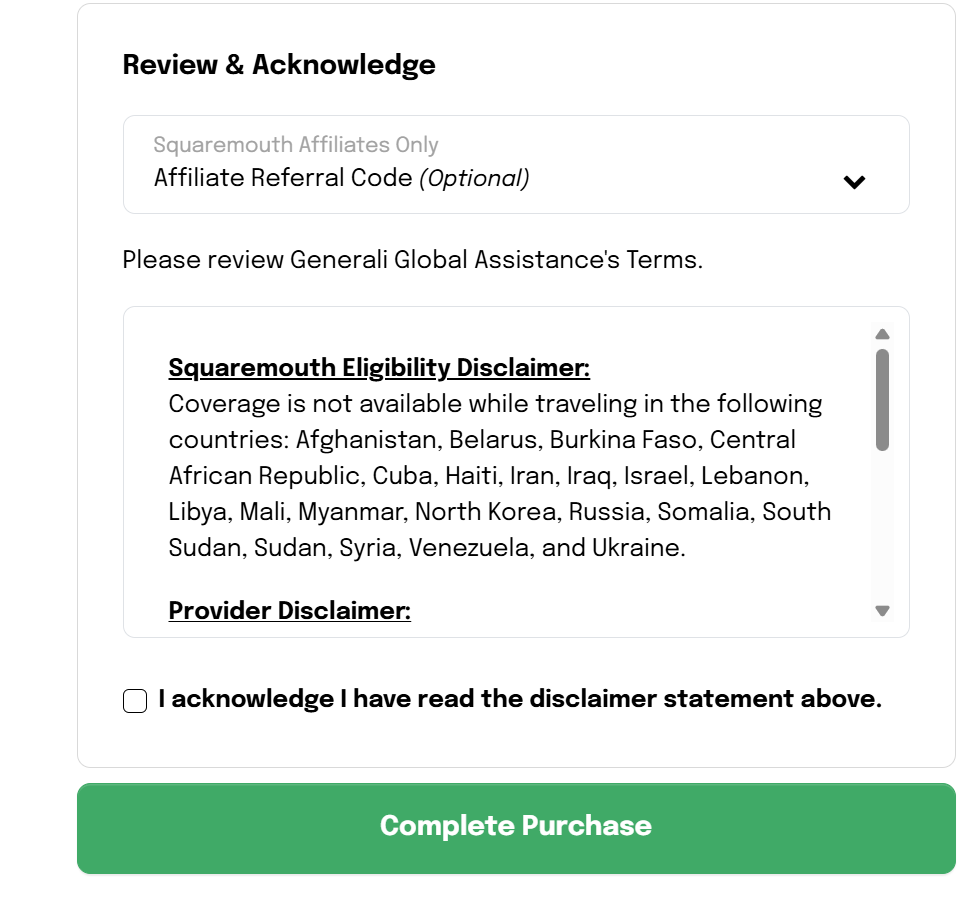

Generali Global Assistance policy disclaimer on Squaremouth’s platform, showing Israel among a list of excluded countries for coverage, including Syria, Venezuela and Russia

5 View gallery

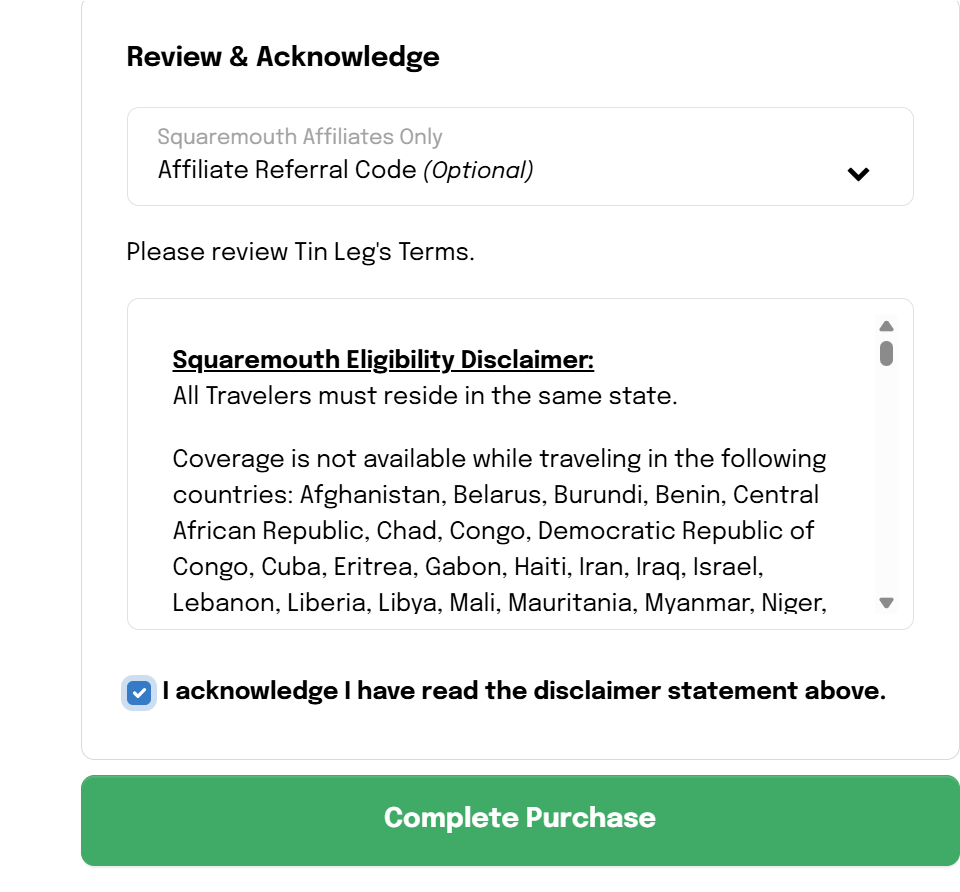

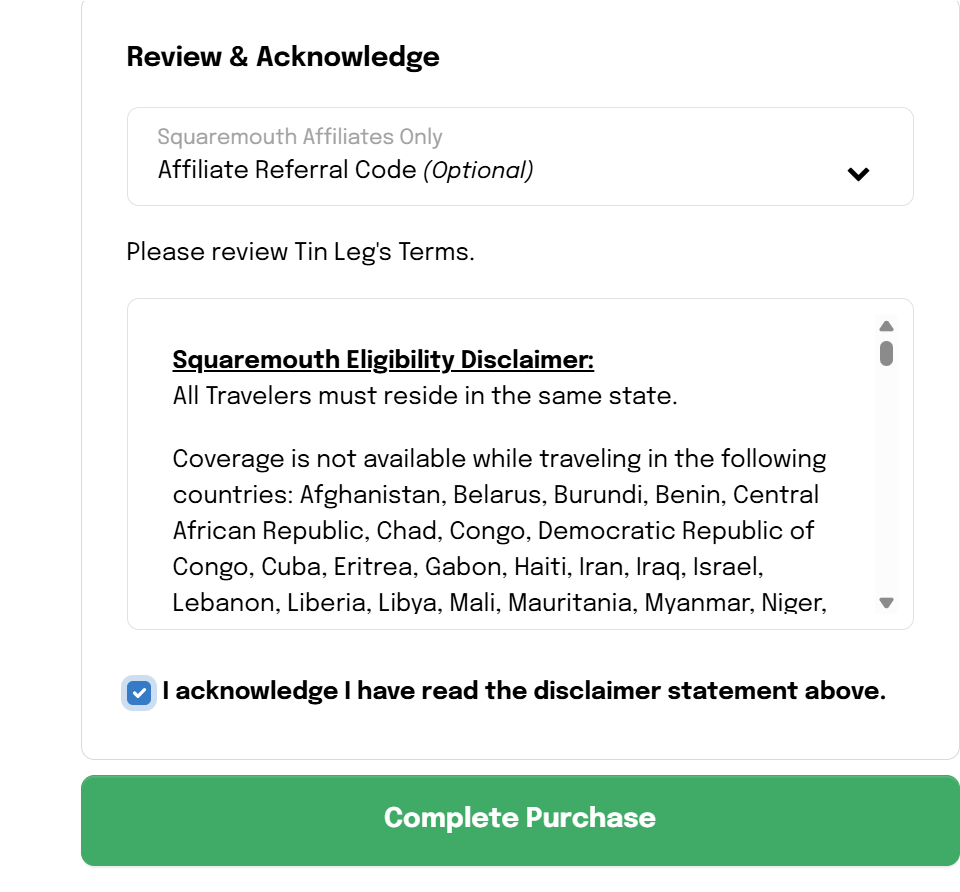

Tin Leg’s insurance policy disclaimer on Squaremouth, listing Israel among countries not covered for travel insurance, alongside conflict zones such as Afghanistan, Iran, Iraq and North Korea

5 View gallery

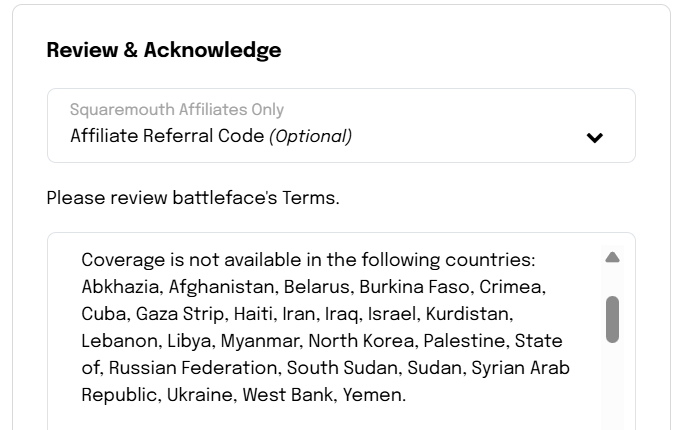

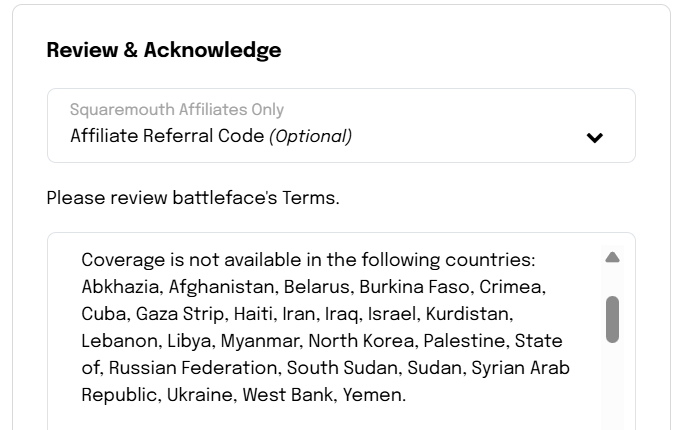

Battleface insurance policy terms on Squaremouth’s website, excluding Israel, the West Bank and Gaza from coverage along with countries like Afghanistan, Belarus and North Korea

Under the “service terms” section, Israel appears in the disclaimer as one of the non-covered countries - an unflattering club that includes Afghanistan, Belarus, Burkina Faso, Cuba, Haiti, Iran, Iraq, Libya, Mali, Myanmar, Russia, Ukraine, North Korea, Sudan, South Sudan, Somalia, Syria and the Palestinian territories (Gaza and the West Bank).

As a rule, insurers base their lists of non-covered countries on the recommendations of the U.S. Department of State. While countries like Afghanistan, Haiti, Iran, Iraq, North Korea, Russia, Sudan and Gaza are under a Level 4 advisory, Israel remains at Level 3, meaning Americans are advised to reconsider travel, but not to avoid it entirely.

According to the official travel advisory, staying in Israel and the West Bank is discouraged due to “terrorism and civil unrest,” while travel to Gaza, the Gaza border region, northern Israel and the border with Egypt is prohibited under a Level 4 advisory. Despite U.S. State Department guidance, insurance companies periodically update the terms and limitations of the policies they offer, as well as the list of non-covered countries. While the lists vary by provider, Israel appears on all of them.

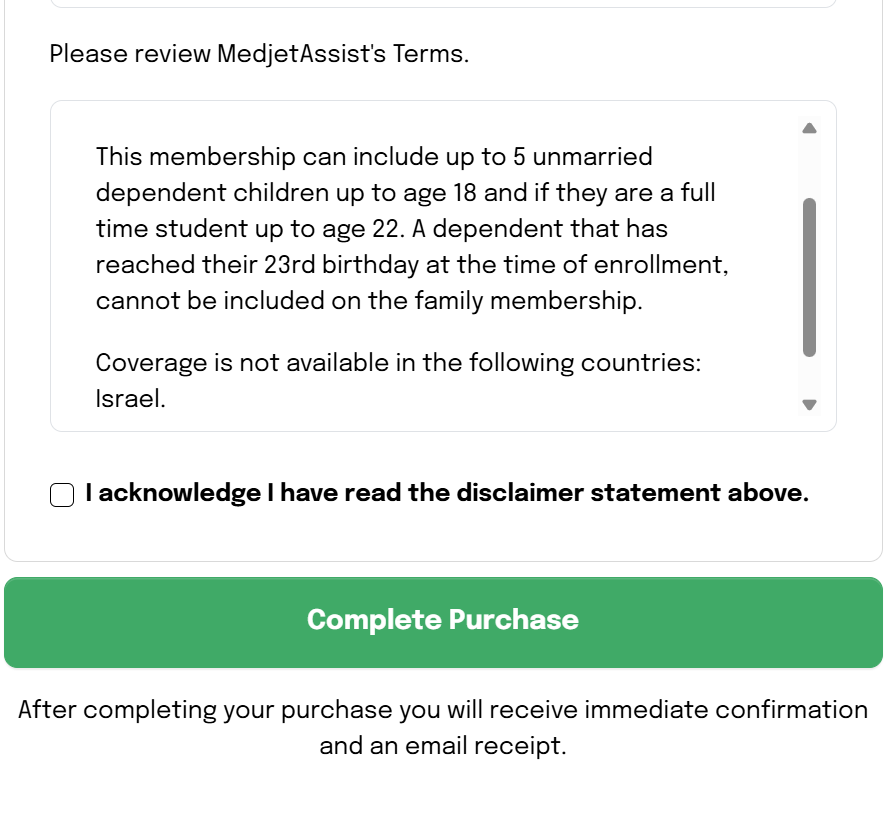

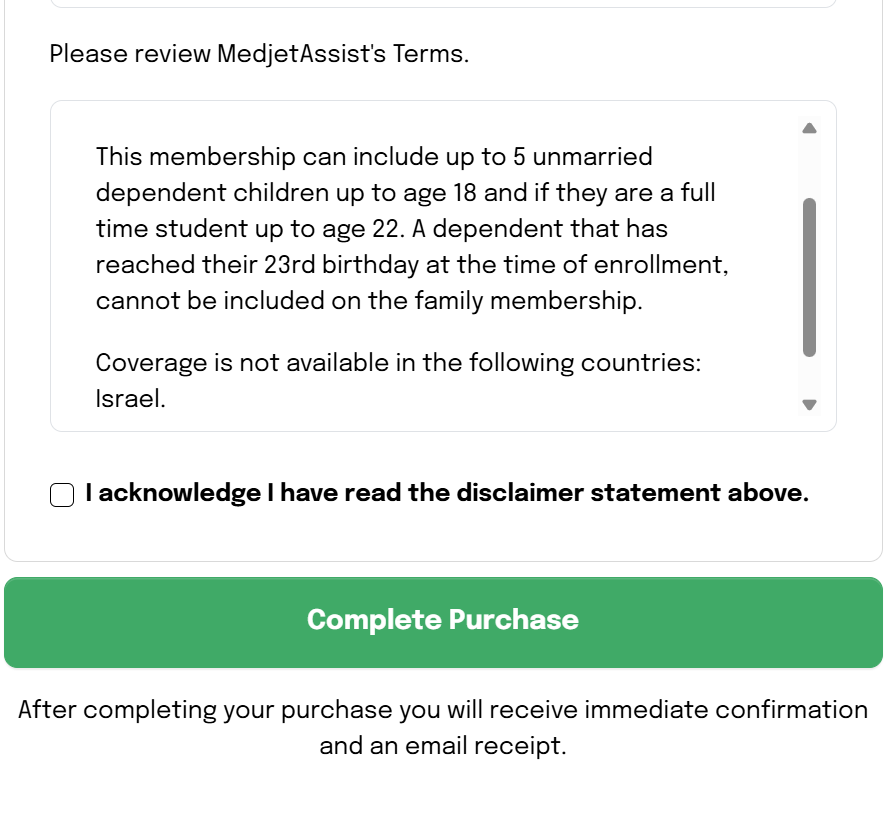

In the case of MedJet, Israel was listed as the only country not covered under the policy's terms. Following an inquiry by ynet, the company stated the listing was an error and there was no intention to single out Israel.

5 View gallery

MedjetAssist terms and conditions section, showing Israel listed as a country not covered under its travel insurance policy

“Thank you very much for bringing this to our attention. Squaremouth is a third-party platform, and we’re not sure why Israel is appearing on their platform as a standalone exclusion on their interface. Medjet’s eligibility rules are based on U.S. Department of State Level 3 and Level 4 advisories, which apply to a broader group of countries and regions worldwide. Israel is one of those destinations at this time, but it is not treated differently or evaluated on a political basis,” a spokesperson for MedJet told ynet, who soon after offered an update:

“We have contacted Squaremouth and explained our own discomfort at having Israel singled out in the way they had it (when all Level 4 countries, and some other Level 3 countries, are currently not serviced). They fully understood the concern and are updating their platform to reflect the broader policy language (“Level 4 and some Level 3 destinations are not serviced”) so it’s accurate and consistent with how our program operates. They are making those visible changes as soon as they can. Thank you very much for bringing this to our attention!”

In response to ynet’s inquiry, a Squaremouth spokeswoman said the platform does offer several travel insurance plans for Israel, though most do not appear in search results. “Squaremouth is an independent travel insurance marketplace, and all destination eligibility and exclusion rules are determined solely by the carriers,” she said. “Our role is to ensure these details are clearly displayed so travelers can make informed choices. Our platform currently offers 25 plans from eight providers that include coverage for travel to Israel, the most of any marketplace.”

Inquiries to other insurance providers went largely unanswered, but Travelex responded: “Many travel insurance providers have ceased to provide coverage for certain countries for any losses resulting directly or indirectly from declared or undeclared war or any act of war. In addition, policies may exclude coverage for any losses resulting from an event that was foreseeable on the date a policy was purchased. This is standard in the travel insurance industry. We are actively reviewing our offerings for travel to Israel and the West Bank and will continue to adjust our travel insurance options based on market conditions and risk assessments. Our goal is always to provide coverage where possible while prioritizing customer safety. We’ll keep monitoring the environment and update our offerings as conditions evolve.”