A proposed California ballot measure that would impose a one-time 5% tax on unrealized gains of residents with a net worth above $1 billion is prompting many of the state’s wealthiest individuals to consider relocating, according to interviews conducted by an independent journalist.

The measure, dubbed by critics as a “billionaire tax,” would apply retroactively to Jan. 1, 2026, if approved by voters in November. The retroactive provision has accelerated planning among business leaders months before any vote is held.

3 View gallery

From right: Sergey Brin, Larry Page and Mark Zuckerberg

(Photo: Paul Sakuma / AP, Evelyn Hockstein / Reuters)

Journalist Mike Solana reported that 20 of 21 billionaires he spoke with said they are preparing to leave California or have already taken concrete steps toward relocating to other U.S. states. Together, he said, the group represents an estimated $1.3 trillion in net worth and is responsible for creating more than 50,000 jobs.

Among those cited as making moves are Meta CEO Mark Zuckerberg, who has purchased property in Florida; Google co-founder Larry Page, who has reportedly shifted portions of his business affairs to Delaware, Texas and Florida; his co-founder Sergey Brin, who is said to be taking similar steps; and Palantir co-founder Peter Thiel, who has opened offices in Miami and distanced operations from California.

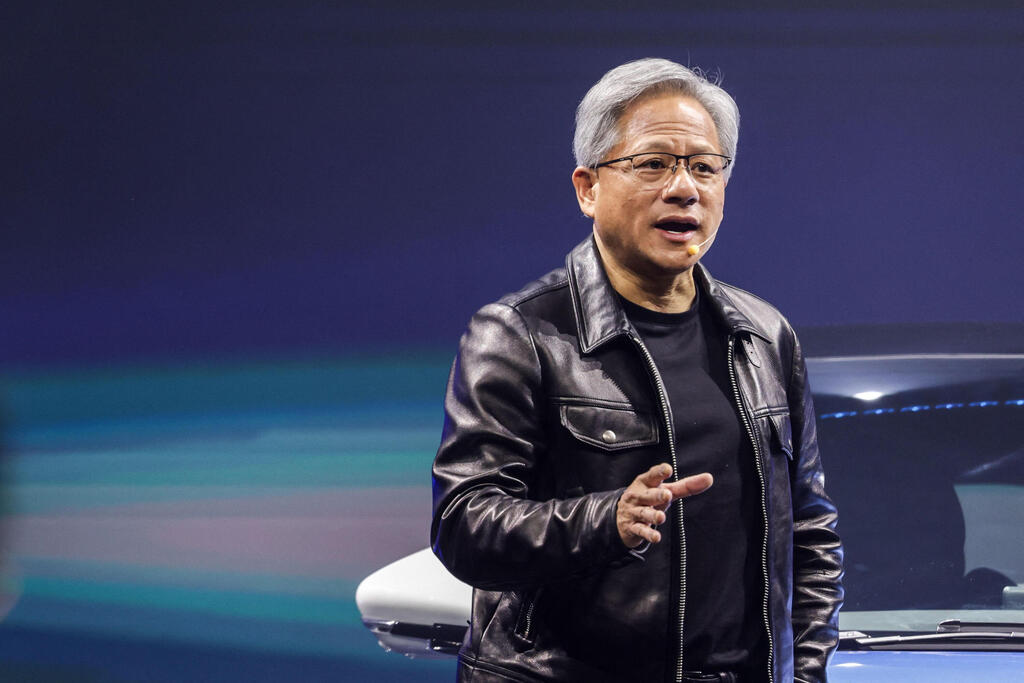

Nvidia CEO Jensen Huang has publicly stated he does not plan to leave and that he is “fine with the tax,” despite broader industry concerns.

In a widely shared social media post, a startup executive outlined potential implications for Alphabet co-founders Page and Brin. According to the analysis, because of the structure of their supervoting shares, the proposed tax could calculate their holdings at higher effective levels, potentially resulting in multibillion-dollar tax liabilities. Critics argue such a framework could amount to what they describe as a large-scale confiscation of private property.

Entrepreneur David Friedberg summarized the opposition by saying the proposal would establish “an organized mechanism of government seizure of private property” for the first time in U.S. history.

Supporters of the measure, backed by labor unions and progressive organizations, say the tax would help reduce extreme inequality, generate stable revenue for the state and fund budget gaps in health care, education and social services.

Business leaders interviewed expressed concern not only about the specific proposal but about broader regulatory risks. One executive said that while the measure is framed as a one-time levy on billionaires, “once it passes, it will expand.”

Some venture capital investors warned that if enacted, the measure could drive technology companies out of the state. “Every CEO would have to look at the numbers,” one investor said. “They would conclude it would significantly damage the company.”

Reported steps taken by wealthy residents include purchasing real estate outside California, consulting tax attorneys to prepare legal challenges and instructing company executives to explore expansion in other states.

Florida and Austin, Texas, were frequently mentioned as potential destinations, though several executives said their decisions would ultimately depend on each state’s specific tax and regulatory framework.

Delaware has emerged as a particularly attractive option for corporate registration. The small state, home to just over 1 million residents, is incorporated by more than 60% of Fortune 500 companies, including Alphabet, Amazon, Apple, Netflix and Meta. More than 90% of U.S. companies that went public in 2021 were registered there.

Business advisers cite Delaware’s specialized corporate court system, flexible corporate laws and predictable legal framework as key advantages that provide certainty to companies and investors.

While some executives may not physically relocate, critics of the proposed tax say corporate restructuring alone could significantly reduce California’s tax base if the measure advances.