The sweeping tariffs announced overnight by U.S. President Donald Trump are set to significantly impact the operations of major tech companies. Among the hardest hit is Apple, as most of the countries where it manufactures its devices are subject to tariffs at the higher end of the scale.

Additionally, the 32% tariffs imposed on Taiwan—where the majority of the world’s advanced semiconductors are produced—are expected to hurt companies like Nvidia, its suppliers, and once again, Apple. Other tech giants could also suffer, particularly if other nations retaliate with countermeasures.

In what he called "America’s Liberation Day," Trump introduced a series of retaliatory tariffs of at least 10% on all countries, with some facing even higher rates. The European Union, for example, will see a 20% tariff on all imports to the U.S., while Chinese imports will be hit with a 34% tariff.

During Trump’s first term, Apple CEO Tim Cook worked hard to cultivate a close relationship with him, efforts that will now be tested as the new tariffs strike at Apple’s most vulnerable supply chain points. The company stands to lose billions unless it secures an exemption from the administration.

China, where 90% of iPhones are manufactured, remains Apple’s most critical production hub. The new tariffs on Chinese goods add to existing ones, bringing the total tariff rate on imports from China to 54%. If Apple is forced to absorb these costs, it will either have to sharply raise prices or suffer a drastic reduction in profit margins.

Apple has spent years trying to diversify its supply chain, recently doubling iPhone production in India. The company has also expanded manufacturing in Vietnam, Malaysia and Thailand to mitigate risks from the U.S.-China trade war. However, these countries were also hit with steep tariffs overnight—26% for India, 46% for Vietnam, 24% for Malaysia, and 36% for Thailand. Ireland, where iMacs are assembled, now faces a 20% tariff.

Financial fallout for Apple

According to Morgan Stanley, tariffs on Apple’s China-made devices could add $8.5 billion to its annual costs, reducing net income by 7%—or $7.85 billion. Sourcing from lower-tariff countries would only partially offset these losses. The announcement sent Apple’s stock tumbling 7.14% in after-hours trading.

During Trump’s first term, Cook successfully lobbied to exempt the iPhone and other Apple products from tariffs by arguing that such measures would harm an American company while benefiting its South Korean competitor, Samsung. However, Trump has made it clear that no exemptions will be granted this time. As a result, Apple faces two choices: significantly raise prices (potentially hurting sales) or absorb the financial blow.

A less likely alternative would be shifting production to the U.S. Currently, Apple assembles only one product domestically—the Mac Pro, built in Texas. The company has made no serious efforts to move more manufacturing stateside and, even if it did, such a transition would take years. Moreover, U.S. assembly wouldn’t eliminate tariffs on imported components, which still make up the majority of Apple’s supply chain.

Without a special exemption, Apple is poised to take a major financial hit.

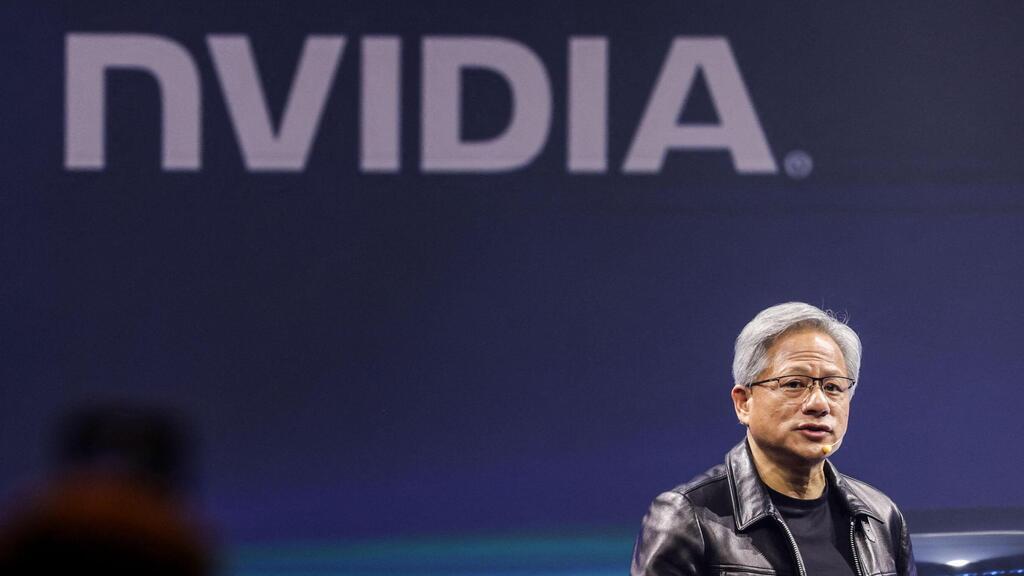

Nvidia and the AI supply chain at risk

While Apple may be the biggest loser among tech giants, it’s far from the only company affected. Google, Microsoft, Meta and Amazon also manufacture hardware—mainly in China—and import it to the U.S., though at a smaller scale than Apple.

More critically, all of these companies are investing hundreds of billions of dollars in AI infrastructure, building massive data centers in the U.S. These facilities rely on imported components, which are now significantly more expensive due to tariffs. The most notable impact will come from the 32% tariff on Taiwan.

Taiwan, home to semiconductor giant TSMC, produces most of the world’s advanced AI chips. Nvidia, which controls 80% of the AI chip market, manufactures nearly all its processors there. AI data centers require tens or even hundreds of thousands of chips—now subject to sharp price increases.

This cost surge will hit not only major tech companies but also OpenAI, which announced a half-trillion-dollar AI infrastructure plan with Trump’s backing, and even one of Trump's closest allies: Elon Musk. Musk’s AI company, xAI, is building two U.S.-based data centers—in Memphis and Atlanta—each costing hundreds of millions of dollars. The Memphis site alone is set to house 200,000 AI chips, with plans to expand to over a million. Tariffs on Taiwanese semiconductors could significantly increase these costs or force companies to scale back their expansion plans.

While TSMC and Intel are building advanced chip plants in the U.S., it will take years before they reach full capacity. Meanwhile, AI firms have no choice but to continue importing expensive processors, given the fierce competition in the sector.

Potential retaliation from Europe

Beyond the direct impact of tariffs, tech giants could also face retaliation from other countries, particularly targeting the U.S. services sector. This sector—including finance, tourism, engineering, cloud services and health care—comprises the bulk of the American economy. In 2024, U.S. service exports contributed $1 trillion to GDP, with a $300 billion trade surplus.

That surplus makes the sector an attractive target for trade countermeasures, especially from the EU. "The European Union has policy tools to expand its retaliation against U.S. tariffs by targeting services," Philippo Taddei, head of investment research at Goldman Sachs, told The New York Times. These tools include a 2021 law allowing the EU to impose tariffs and restrictions on digital services and intellectual property.

Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iNv

All major U.S. tech firms generate significant revenue from services in Europe. Amazon, Microsoft and Google dominate the global cloud market. Apple earns billions from the App Store, Apple Music and Apple TV+. Google profits from Google Drive and digital ads. Amazon’s Prime Video and Amazon Music are widely used across the continent. Meta relies on ad sales through Facebook and Instagram, while Netflix's entire business is subscription-based streaming.

In response, the EU and other countries could impose new digital taxes, mandate local tax payments on services (circumventing offshore tax avoidance schemes), or adopt policies similar to the U.K.'s 2020 digital services tax, which collects 2% of revenues from search engines, social media platforms, and online marketplaces—raising about $1 billion annually. The U.K. may use this tax as a bargaining chip to negotiate lower Trump tariffs.

U.S. tech giants were already under regulatory pressure from the EU, which has forced them to make significant operational changes. For instance, Google was compelled to modify search result rankings to avoid favoring its own services, and Apple had to allow third-party app stores on the iPhone. This week, the European Commission is expected to announce new fines against Apple and Meta for violating the Digital Markets Act (DMA).

Further retaliatory measures against tech giants could escalate tensions between the U.S. and the EU.

For now, one thing is certain: Trump’s tariffs are creating a wave of uncertainty for the tech industry, with no clear resolution in sight.