American chipmakers believed as recently as last Wednesday that they would avoid the fallout from President Donald Trump’s sweeping new tariffs on imports to the United States. The initial announcement suggested an exemption—at least temporarily—for microchips.

But by the weekend, when the final list of exemptions was published, it became clear that many products indirectly tied to the chip industry would not be spared.

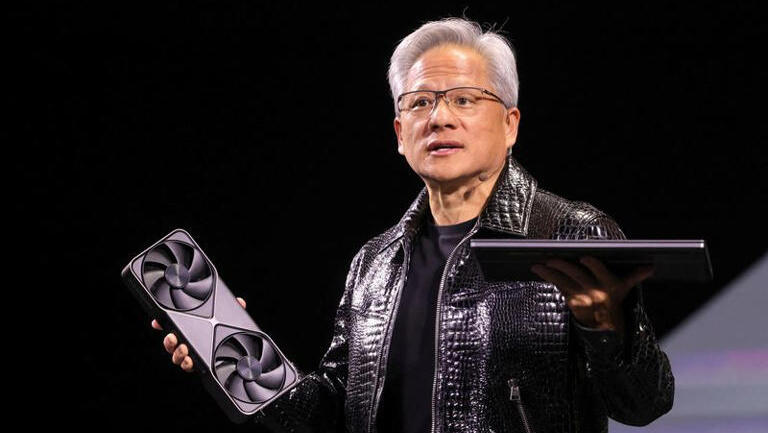

While the tariffs do not directly target computer chips, they do apply to servers containing those chips and the smartphones that rely on them. For example, Nvidia’s DGX servers—used for artificial intelligence applications and manufactured outside the U.S.—will be subject to steep import duties. According to Wired magazine, only 20% of the more than 1,300 items listed on Nvidia’s website are exempt under the new policy.

Trump’s tariffs will also cover critical components of chip production, including steel, aluminum and water treatment technologies. The repercussions are already clear: prices are expected to rise on a wide range of consumer electronics including smartphones, laptops, tablets, earphones, smartwatches and gaming consoles. These increases could lead to lower sales, or force manufacturers to absorb the added costs—cutting into profit margins.

Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iNv

This could deal a serious blow to America’s goal of leading in artificial intelligence and quantum computing. Apple is projected to take the biggest hit among tech giants, but Google, Meta and Microsoft—who also manufacture many of their products overseas—are expected to suffer major losses as well. Their massive server farms, built at the cost of billions to power AI systems, will also become more expensive to maintain.

3 View gallery

Eilon Musk with fellow American tech giants at Trump's inauguration

(Photo: Saul Loeb, Reuters)

Key components of the U.S. semiconductor industry are embedded in a vast array of imported consumer goods—from cars to refrigerators—and will now be subject to especially high tariffs. While U.S. chipmakers currently represent only a small share of the global market, the Biden administration had allocated $52 billion to expand their reach.

The new tariffs, particularly felt across Southeast Asia, threaten to undercut U.S. efforts to reduce reliance on Chinese production. Even Taiwan—home to TSMC, the world’s largest advanced chip manufacturer—will face a 32% tariff on server exports.

Retaliation is also a looming concern. Countries hit hardest by the tariffs are expected to respond with duties on U.S. goods and services, potentially impacting American digital platforms such as Google Play, Apple’s App Store, Netflix and Microsoft Office.