Annabella, the Israeli startup behind the world’s only breast pump that mimics a baby’s natural tongue motion, is entering its next fundraising phase as it prepares to commercialize a breakthrough wearable model and accelerate global expansion.

The share offering is being conducted under the company’s Shelf Offering Report dated November 2025, which includes all required disclosures. A full prospectus and financial statements are available for review here.

Record sales growth across key markets

The company, which is backed by the Israel Innovation Authority and notable private investors including well-known “Shark Tank” figures Oren Dobronsky and Yasmin Lukatz, reports that it delivered on every key target from its previous round, achieving approximately 2.5x revenue growth in the first half of 2025 versus the first half of 2024, while raising gross margins from 27% to 38%.

More than 15,000 units have been sold in Israel, the U.S. and Europe, with online sales in the U.S. rising nearly 95% and distributor sales in Israel and Europe climbing 411% over the same period.

Wearable pump positioned as next major growth engine

Annabella’s next strategic milestone is the launch of its wearable pump: a miniaturized, quieter, bra-inserted solution integrating its patented tongue mechanism—clinically shown at Shamir Medical Center to extract on average 50% more milk while offering a more pleasant experience. The Annabella team believes the new wearable will align with market trends, reduce production costs, improve margins and become the company’s main growth engine.

Its business footprint is already widening. In the U.S., Annabella secured reimbursement-eligible distribution agreements with three major durable medical equipment (DME) players—Dynquest, Blue Goose and Enos Healthy Baby Essentials—and is offered on Babylist, which controls around half of America’s baby registry market. In Europe, a three-year exclusive agreement with Klein AG resulted in an initial order of thousands of units and binding minimum purchase commitments reaching 22,500 units by 2027, later extending to online sales in France, Italy and the Netherlands. Spain placed its first order in 2025, and the UK is expected to follow in Q1 2026.

A consolidating market with high exit potential

Industry data positions Annabella within a lucrative market. Willow, a U.S. wearable-pump competitor without Annabella’s tongue mechanism, has raised $282 million; Avent was sold to Philips for $689 million; Evenflo was acquired for approximately $143 million. These deals reflect ongoing consolidation in a sector pushed forward by long-term breastfeeding policies from the WHO and UNICEF—and dissatisfaction with conventional pumps.

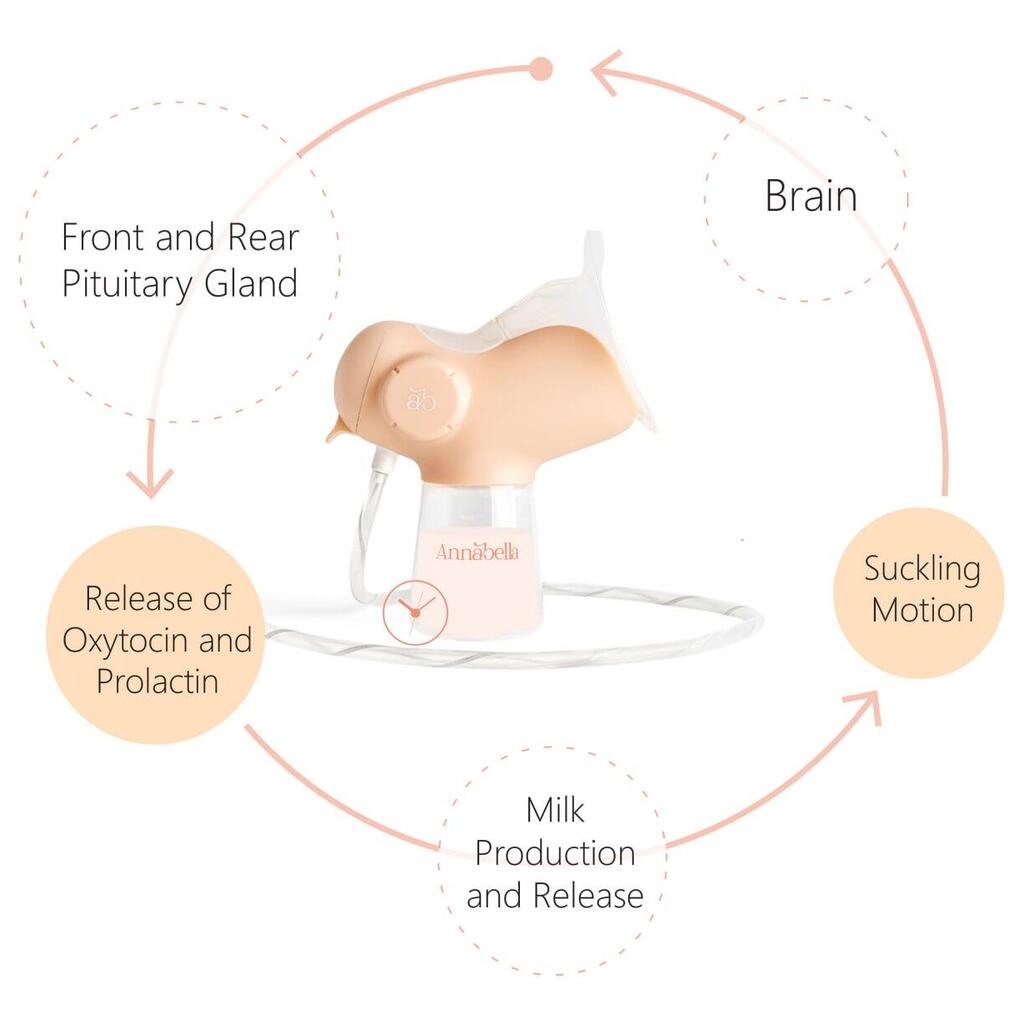

Annabella’s founders argue the opportunity lies in replacing legacy vacuum-based pumps derived from 1850s cow milking machines. Its patented tongue system—approved in the U.S., China, Japan, India, Korea and Europe—mimics the baby's tongue, known to stimulate prolactin and oxytocin production, improving output and comfort. Beyond hardware, the company is building a broader breastfeeding ecosystem, with accessories now accounting for 14% of revenue and manufacturing efficiencies reducing costs by more than 45% over the last two years.

Next launch cycle set for 2026

Annabella plans to introduce its wearable pump in Israel and Europe in mid-2026, and thereafter in the U.S., alongside expansion into Walmart and Target and the development of additional breastfeeding products such as a bottle warmer. Hopefully successful, it may emerge as one of Israel’s notable consumer health exits—supported by award wins including “Best of the Bump” and Baby Innovation Award recognition, and a malfunction rate below 2%.

The fundraising campaign is open to participants starting at 6,600 shekels. Interested parties can review the prospectus and access the investment page through the company’s campaign link in collaboration with Exit-Valley.

*In collaboration with Annabella