The billionaire tech mogul has set an exceptionally ambitious target for Tesla’s development team: to outpace the chip development cycles of industry giants Nvidia and AMD.

The goal is to turn Tesla into the world’s largest producer of artificial intelligence chips by volume, integrating them into millions of vehicles and robots.

An especially ambitious vision

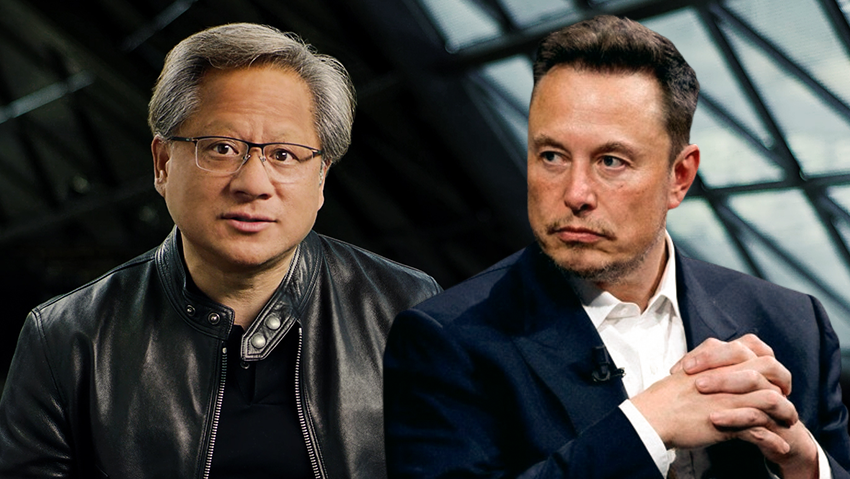

In a post that sent shockwaves through social media and the tech world on Monday, Elon Musk, Tesla’s CEO, unveiled the company’s most ambitious hardware roadmap to date. According to Musk, Tesla plans to shorten the development cycle of its AI processors to just nine months, a pace significantly faster than the annual cadence maintained by major rivals Nvidia and AMD.

“Our AI5 chip design is almost done and AI6 is in early stages,” Musk wrote. He went on to add: “There will be AI7, AI8, AI9 … aiming for a 9-month design cycle.” The statement marks a sharp strategic shift for Tesla, which until now has rolled out major hardware updates for its vehicles, such as the transition from HW3 to HW4, over intervals of several years.

While Nvidia, the undisputed leader of the AI market, adheres to annual launches of new architectures, such as the Blackwell and Rubin series, to maintain its technological edge, and AMD invests heavily in its MI lineup to close the gap, Tesla is now seeking to leapfrog both.

The key difference in Musk’s strategy lies in the intended use of the chips. Whereas Nvidia’s and AMD’s GPUs are primarily designed for servers and data centers, often priced at tens of thousands of dollars per unit, Tesla’s chips are meant for mass production on an unprecedented scale.

“These will become the highest-volume AI chips in the world, by a huge margin,” Musk said. His vision is to equip every future Tesla vehicle, as well as the planned humanoid robot Optimus, with these processors, leading to the production of millions of units annually, volumes unmatched by any server chipmaker.

Experts express skepticism

The push to compress the development cycle to nine months has been met with skepticism among hardware experts. Unlike chips designed for climate-controlled data centers, processors for autonomous driving must meet the most stringent safety standards, such as ISO 26262. They are required to operate under extreme temperatures and vibrations and to include redundancy systems to prevent critical failures while driving.

In the traditional automotive industry, the development of a safety-critical chip typically takes three to five years. Verification and safety certification processes are often longer and more complex than the silicon design itself.

Experts estimate that to meet a nine-month target, Tesla is unlikely to develop an entirely new architecture with each generation. Instead, the company is expected to pursue rapid, iterative improvements based on an existing platform, a strategy that would allow it to maintain an approved safety framework while increasing computing power, adjusting cache memory (SRAM) and improving data throughput.

Background: China’s growing clout

Tesla’s move comes amid intensifying global competition in autonomous driving chips. In China, the world’s largest electric vehicle market, local players such as Huawei, with its Ascend chip series, and Horizon Robotics, with its Journey processors, are offering strong and cost-effective alternatives that challenge Western dominance.

These companies already operate on relatively fast development cycles, though none have yet reached the pace Musk is targeting. Tesla’s ability to control the entire value chain, from silicon design and operating systems to the final vehicle, gives it a relative advantage through vertical integration, potentially enabling faster progress than rivals dependent on complex external supply chains.

Despite Musk’s optimism, reports suggest the AI5 chip will deliver a significant performance leap. However, the real bottleneck may not lie in chip design or fabrication at advanced foundries such as TSMC, but in the ability to recruit enough skilled engineers.

Musk’s call for engineers to join the development team underscores the urgent need for fresh talent to sustain such a pace. In addition, the main constraint is expected to be software testing and validation, a stage where even minor bugs can cost lives and therefore cannot be meaningfully rushed.

If Tesla succeeds in maintaining a nine-month cycle, it would not only rewrite the rules of an automotive industry long viewed as slow and conservative, but could also emerge as a key player shaping the global semiconductor market, holding a decisive advantage in automotive AI.