In a symbolic turn of events, the same week Nvidia doubled its office space in Israel and continued to hire dozens of new employees monthly, chip rival Intel announced sweeping project cancellations and hundreds of layoffs across its Israeli operations.

The contrast between the two semiconductor giants couldn’t be starker. Nvidia, riding a wave of momentum powered by a string of savvy tech and business decisions, now commands the AI chip market. Intel, meanwhile, is reckoning with years of missteps.

Just a few years ago, Intel was the undisputed heavyweight of personal computing. Nearly every PC bore the familiar “Intel Inside” sticker. The company dominated the CPU market and spent billions acquiring tech firms—many of them Israeli startups.

But the tide has turned. Intel missed the smartphone revolution, failed to pivot toward AI server hardware, and watched as Nvidia’s graphics chips—originally designed for gaming—emerged as ideal processors for artificial intelligence.

Intel’s focus remained fixed on CPUs, where it still holds over 56% of the global PC market and close to 73% when including servers. That leadership, however, now seems fragile. In 2023, Intel’s stock plunged 60%, driving its market value below $100 billion for the first time in three decades.

Leadership shakeups and hard choices

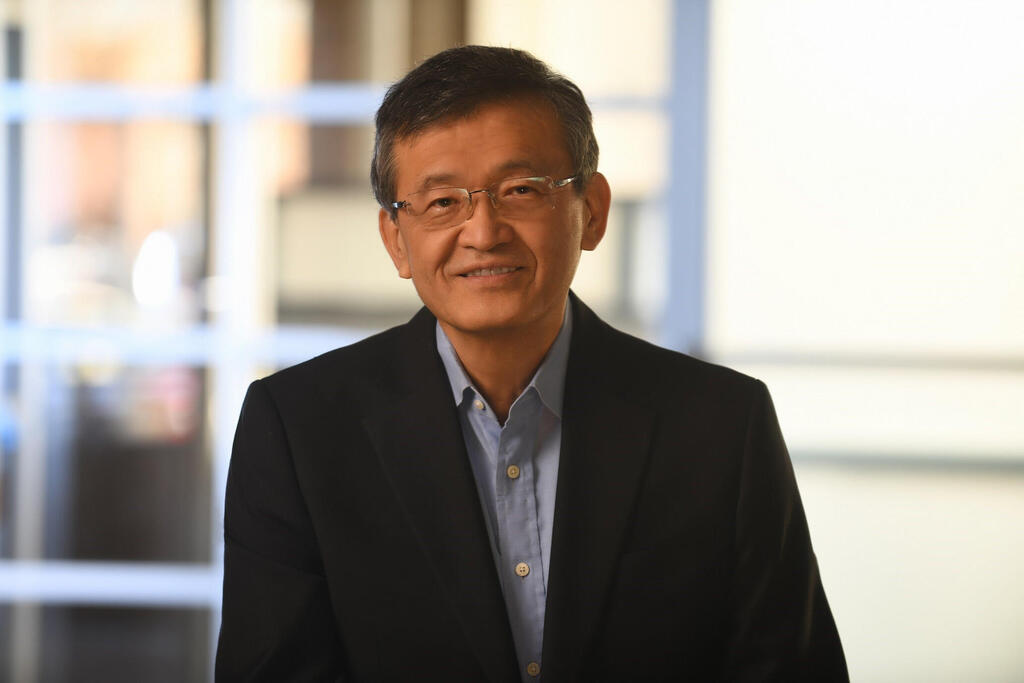

Lip-Bu Tan stepped down as CEO in December 2024 after a rocky tenure marked by missed targets and deep cost-cutting. He was replaced in March by Lip-Bu Tan, a Malaysian-born entrepreneur, investor, and longtime chip industry insider.

Tan brings an impressive resume: degrees in physics and nuclear engineering, an MBA, and a history of investing in and advising numerous semiconductor firms—including several in Israel. His arrival marks what some insiders see as Intel’s last best hope to reverse its trajectory.

His mission is daunting: defend CPU market share from AMD and Arm, break into the AI chip sector dominated by Nvidia, and streamline a bloated business weighed down by underperforming divisions.

But Tan’s immediate focus appears to be cultural. Intel’s decades-long dominance created layers of bureaucracy that stifled agility and innovation. “We are the founders of a new Intel,” he wrote to employees upon taking the helm. “We will learn from past mistakes, turn obstacles into growth engines, and choose action over distraction.”

Deep cuts, painful changes

Among Tan’s first major moves: a sweeping round of layoffs aimed at flattening management and preserving Intel’s core engineering talent. Reports in April suggested the company was preparing to cut up to 20% of its global workforce—more than 20,000 employees. While this isn’t Intel’s first belt-tightening effort, the scale marks one of the most aggressive in its history.

Last year alone, Intel laid off 15,000 workers globally after implementing earlier cuts to bonuses and perks. The goal: trim $10 billion in expenses—a target set during Tan’s tenure that remains unmet.

The next wave of layoffs is already underway. The company has notified employees at its flagship manufacturing site in Oregon that job cuts will begin next month, potentially affecting 2,000 workers. This follows 3,000 job losses at the same site the previous year.

In Israel, Intel’s headcount has declined from a peak of 12,000 in 2021 to around 10,000 today. About 200 manufacturing employees at its flagship Kiryat Gat chip plant are reportedly set to receive layoff notices. The facility, which employs approximately 4,000 people, remains a cornerstone of Intel’s global production strategy.

While Intel still matters in the chip world, it is a company in transition. The question now is whether Tan can rewire the corporate DNA fast enough to compete in a new era—one increasingly shaped by AI and led by rivals who were once the underdogs.

Strategic relationship with Israel remains intact

Intel’s relationship with Israel stretches back decades, beginning in the 1970s when co-founder Dov Frohman opened the first local facility. Since then, Israel has become a key R\&D and manufacturing hub, supported by government incentives and tax breaks. The government’s ongoing support has played a vital role in Intel’s repeated decisions to invest in the region, even as rocket attacks from Gaza threaten operations in the south.

Get the Ynetnews app on your smartphone: Google Play: https://bit.ly/4eJ37pE | Apple App Store: https://bit.ly/3ZL7iNv

Intel CEO Lip-Bu Tan continues to prioritize Israel in the company’s future. Under Tan’s leadership, the company recently transferred high-impact chip design projects to Israeli teams. Panther Lake, Intel’s most advanced upcoming processor, was developed under Israeli leadership and is expected to hit the market soon.

Shift in focus: Core businesses and GPU-AI war

Intel’s broader recovery plan hinges not only on layoffs, but on accelerating core businesses. While past strategies leaned heavily on building its own foundries—a move that mirrored Taiwan’s TSMC—Tan is taking a more nuanced approach. Intel is now in talks with TSMC, exploring joint ventures and shared manufacturing to remain competitive in high-end chipmaking.

At the same time, Intel is doubling down on AI-focused GPUs to challenge Nvidia’s 80% market dominance. Although its AI chip performance on paper appears competitive, the company still struggles to convince enterprise customers to pivot away from Nvidia’s entrenched position. To bolster its AI ambitions, Tan has brought in veteran executives from Apple, Google, and Cadence to lead AI, GPU, and customer excellence divisions.

In a bold technological leap, Tan plans to skip the current 18A manufacturing node and fast-track development of the next-generation 14A process by 2026. The aggressive move could help Intel gain ground against TSMC and appeal to premium clients like Apple—or even Nvidia.

Asset sales and cost-cutting measures underway

Intel’s restructuring also includes trimming non-core operations. Recently, it sold its stake in Altera to Silver Lake for $8.75 billion—at a loss compared to its 2015 acquisition price. The company is also planning to divest its networking chip unit and has already shuttered its automotive chip division, laying off several hundred employees. Despite assurances that Mobileye would not be affected, Intel sold 45 million shares of the Israeli company for $900 million, reducing its stake below 80%.

Intel aims to cut $1.5 billion from its operational costs, with $500 million in reductions expected this year. The company will outsource much of its marketing to consulting firm Accenture and tighten financial discipline—greenlighting only projects with a minimum 50% gross margin.

“The turnaround won’t be easy or overnight,” Tan said in his first public remarks. “But I’m confident we’ll get there.”