Israeli stocks fell sharply Sunday amid renewed fighting in Gaza, as renewed clashes between the IDF and Hamas rattled investor confidence and weighed heavily on the Tel Aviv Stock Exchange.

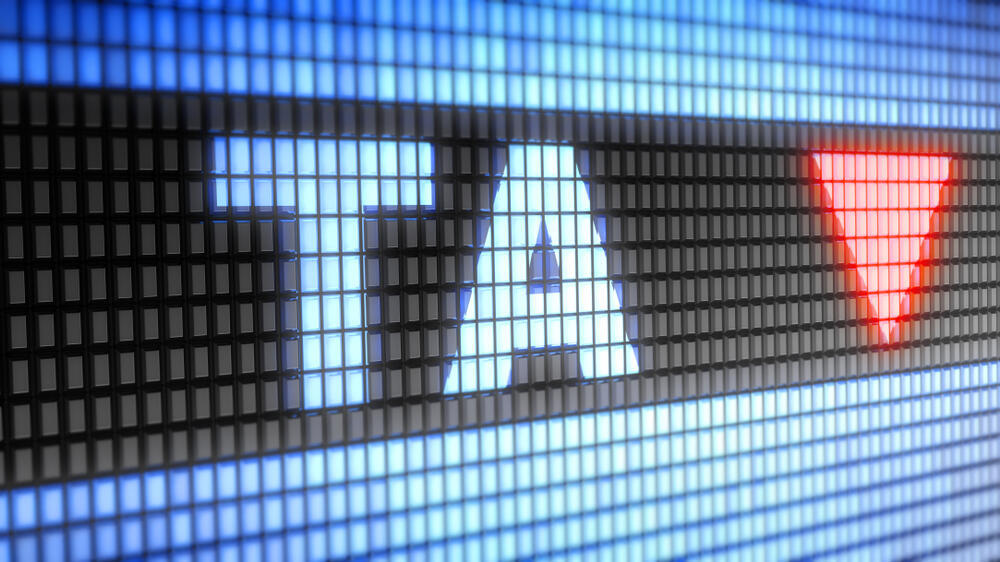

The benchmark TA‑35 index dropped about 1%, while the TA‑90 shed 1.7% after an earlier dip of 2.6%. The broader TA‑125 index fell by approximately 1.3%.

Real estate and construction stocks were among the hardest hit. Shares of Amram Avraham declined 2.4%, Aura lost 2.9%, Electra Real Estate fell 3.7%, Israel Canada dropped 5.2% and Shikun & Binui slid 4.1%. As a result, both the TA-Construction and TA-Real Estate indices were down roughly 3%.

The sell-off followed reports Sunday morning of anti-tank fire directed at an Israeli engineering vehicle near Rafah in southern Gaza, just over a week after the start of the ceasefire and a partial IDF withdrawal from the enclave. The Israel Air Force responded with strikes in the area, and Palestinian sources claimed Israeli navy vessels also opened heavy fire toward the coast.

On Friday, a prior ceasefire breach had already triggered tensions when armed terrorists emerged from tunnels near Khan Younis and Rafah. The IDF reported it had eliminated several gunmen posing an “immediate threat” to troops operating in accordance with the truce agreement.

Sunday’s market downturn reflects growing uncertainty over the stability of the truce and broader concerns about the economic fallout from any potential escalation in fighting. Defense Minister Israel Katz and the IDF’s military secretary left a Cabinet meeting for urgent consultations shortly after reports of the attack.