Nvidia’s upcoming earnings report on November 19 has become one of the most closely watched events of the year on Wall Street, with investors looking for clarity on whether the artificial intelligence boom is losing steam or simply entering a more volatile phase.

The company’s May 2023 forecast, delivered months after the launch of OpenAI’s ChatGPT, marked a turning point for both Nvidia and the broader market. Its revenue projection, nearly double analysts’ expectations at the time, ignited a historic rally. Nvidia added more than $3.5 trillion in market value over the next two and a half years, and the Nasdaq Composite climbed about 88 percent to its recent record.

This time, the mood is markedly different. Skepticism about AI spending has reached its highest level since before Nvidia’s breakthrough outlook last year. Investors are questioning whether the billions poured into AI infrastructure will deliver profits anytime soon, and whether companies are stretching their balance sheets to chase uncertain returns. Meta’s stock, for example, has fallen nearly 20 percent since warning of sharply higher AI costs, and an index of the Magnificent Seven tech giants has slipped about 6 percent. Nvidia shares themselves are down more than 8 percent since late October.

Nvidia is expected to report about $55 billion in third-quarter revenue, a 56 percent increase from a year earlier. Wall Street projects adjusted earnings of roughly $1.25 a share, up 54 percent. Strong guidance for the fourth quarter, estimated at around $61.5 billion, would signal that demand for AI chips remains intense and that Nvidia’s blockbuster Blackwell and upcoming Vera Rubin processors will continue driving growth.

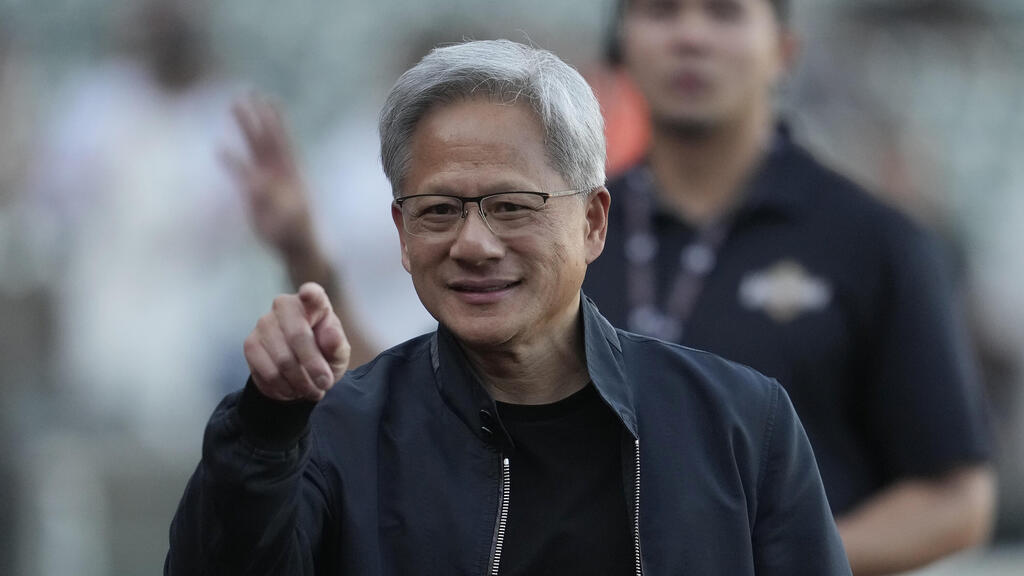

CEO Jensen Huang has hinted at more than $500 billion in cumulative Blackwell and early Rubin chip demand through 2026. Supply limits make that number unlikely, but the comment underscores how confident the company remains in its long-term pipeline. Nvidia is not scrambling to win AI business. It already controls the market and has a broad view of customer spending plans across hyperscalers, model builders, and AI infrastructure firms.

Yet risks are rising. Tighter U.S. export rules could cut billions of dollars in potential sales to China. Cloud providers may slow their data center buildouts. AMD and other rivals are pushing lower cost alternatives. The debate over whether AI is in a bubble intensified again this fall, with venture capitalists acknowledging speculative excess while still pointing to huge opportunities across software, infrastructure, and model development.

If Nvidia delivers a strong report and upbeat guidance, analysts say the stock could surge as much as 30 percent and help revive the broader tech trade. A softer outlook could deepen concerns that growth is normalizing faster than expected.

For now, the future of the AI rally rests heavily on Nvidia’s next move. Investors will soon learn whether the company can once again calm the market’s nerves or whether the doubts surrounding AI spending will only grow louder.